Best In Rare Earth Class And Undervalued: Tasman Metals

Oct 15 2013, 11:15 | about: TAS, includes: ANLKY.PK, ARAFF.PK, AVL,FREFF.PK, GDLNF.PK, GWMGF.PK, HREEF.PK, LYSCF.PK, MCP,MHREF.OB, NMREF.PK, QRM, REE, TRER.PK

1. Introduction

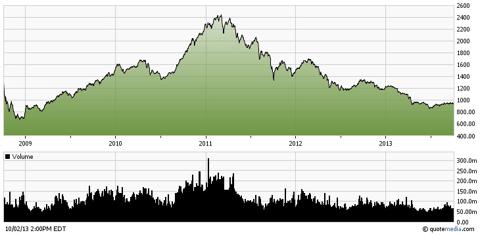

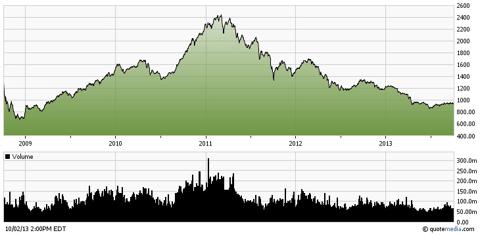

For a few months, I noticed increased attention for rare earth junior mining companies after a long period of relative silence. It must have been more than two years since I sold my own, highly speculative, rare earth plays Great Western Minerals and Stans Energy. My IB platform let them go just one day after they spiked on February 8, 2011 when these stocks fell through my trailing 20% stop-loss, which I like to use in a run up for this kind of speculative stocks. Looking back, this day could have been the end of the rare earth elements (REE) hype at that very moment, and the start of a formidable retraction of all mining stocks, as the most speculative stocks usually go down first when confidence starts to seep out of the markets.

(click to enlarge)

TSX Venture, 5-year period

Back then, it didn't matter which rare earth stock was picked, everything that barely mentioned "rare earths" went up 500-1000% within the previous 6 months. This was often based on nothing but some drill results, an inferred resource estimate or some vague promises by companies, driven by expected implications by the Chinese restricting REE exports at that time, sending REE prices through the roof. Very complex issues like metallurgy or cash costs weren't known or regarded at all. It was a time when some overly enthusiastic analyst reports came out, among others estimating targets like $160 for Molycorp (

MCP) (back then trading at $50, now at $7.40). These days are long gone now, REE prices have come down 80-90% as China normalized exports, and most REE companies lost 80-95% of their value as a consequence. Since 2011, a distinction slowly arose between light and heavy rare earth minerals as the heavy REEs (HREEs) appeared to be really rare, compared to light REEs (LREEs) which were found in large deposits globally. The LREEs are produced in abundance in China (and later on also by Molycorp and Lynas), and therefore always have been relatively very low priced, compared to the HREEs. Just a few companies outside of China managed to build a solid business case based on heavy REEs since 2011, cases that actually could result in a producing rare earth mine.

The company which came out on top during my research to find the best REE explorer of the moment is

Tasman Metals (

TAS), whose flagship project Norra Karr contains one of the highest percentage of heavy REEs at 51.8%, and recently produced a Preliminary Economic Assessment (PEA) with one of the highest Internal Rates of Return (IRRs) of all junior REE miners with substantial deposits. Very important as well is Tasman Metals' initial capex, which is much lower than those of most of its peers, as it is very difficult nowadays (or anytime soon) to raise the necessary funds. An extensive comparison on much more parameters will be made in this article between Tasman Metals and its peers to show why this company could be considered best in class. A target share price for 2017 (when the company expects to reach the commercial production phase) will be estimated as well, and I will also provide a current target share price as I am convinced the company is undervalued at the moment.

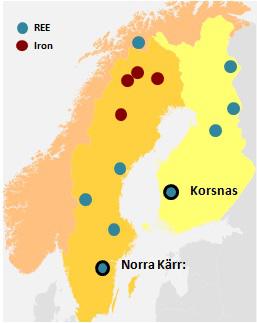

(click to enlarge)

REE projects worldwide

2. Executive summary

Tasman Metals (TAS, or on the Canadian main board: TSM.V) is a Canadian based and Scandinavian focused mineral exploration company with extensive claim holdings in Sweden, Finland and Norway that are prospective for strategic metals, including rare earth elements, iron ore and

very recently also tungsten. Its flagship project Norra Karr contains one of the highest ratios of heavy REEs at 51.8% and the company recently announced a very positive Preliminary Economic Assessment (PEA) on July 9 of this year. The PEA reveals a high after tax NPV@8% of $1,464M, one of the highest after tax IRRs (45%), of all junior REE miners with substantial deposits in combination with a relatively very low initial capex of $266M (including a healthy 20% contingency).

As Tasman Metals has very good fundamentals, actually the best of all REE-juniors as far as I am concerned, it would likely be just a matter of fast-tracking towards production in 2017, as the project is already considerably derisked by the latest PEA and the already obtained test results on metallurgy.

First positive catalyst could be better than expected results of ongoing metallurgy testing at its pilot plant, to be expected in November/December 2013.

After this, Tasman is expected to finalize the conversion of Indicated resources into Measured resources by an updated NI43-101 resource estimate, in Q1 2014.

Next up is the release of a Pre-Feasibility Study (PFS), scheduled for Q2 2014. which will be very important as it could confirm or even improve the very good PEA results, and derisks and fine-tunes the project further. The release of a Feasibility Study (FS) is planned for Q1 2015. When the FS is positive, or even after a positive PFS, construction is expected to begin in Q3 2015, and production in Q1 2017.

One issue that can have a large, positive impact on the business case of Tasman Metals, is increasing of the prices of rare earth minerals. Prices have come down 80-95% since the absolute peak in 2011, stabilizing roughly at 100-300% above 2010 prices, and rising again lately.

There are also negative catalysts. As the rare earth industry is dominated by China (92-97% of global production), any interruption or increase of supply by this country could have serious ramifications for pricing levels globally, rendering the case of Tasman Metals less positive in case of supply increase. I already explained in

another article why I don't consider China a very trustworthy party to deal with, this will remain a risk for some time to come. For now the situation seems to be under control, but as China has its own agenda things could change rapidly.

Other risks are of course negative results and outcomes on all scheduled estimates and reports. I don't expect the resource estimate and PFS to disappoint, as the deposit is very consistent and the PEA is already conservative in its fundamental metrics. In the longer term (2014-2015 onwards) some of the competitors could cause problems when they manage to commence commercial production before Tasman Metals does, as they are more likely to provide enough supply first and win the HREE production race in this case. Despite a lot of rosy schedules of these competitors, this isn't very likely to happen as already further advanced companies have serious disadvantages in raising funds for construction, being able to compete on HREE territory, or obtaining mining permits.

To determine the value of the company, a combination of a derisking factor based on extensive peer comparison, this year's price action of its peers and a discounted NPV/market cap ratio is used. Taking into account a current share price of $0.72 (10/11/2013), based on 60.85M shares we get a target share price of $1.08, for an estimated profit of 50% at this moment. For investors with more patience, in 2017 when Norra Karr should be in commercial production, the target share price is estimated with a very conservative 50% discount on NPV@8% at $5.94 for an estimated profit of 725%.

Tasman Metals, geographical distribution of projects

3. Rare Earth Elements

Before describing the company, I would like to provide some background information on rare earth elements itself. Rare earth elements are used in many alternative energy, lifestyle, and defense applications. Alternative energy systems such as wind power generation, fuel cells, hydrogen storage, rechargeable batteries, and the permanent magnets used in electric and hybrid-electric vehicles all rely on rare earths. REEs are used as phosphors in many consumer displays and lighting systems, and are used in fluid cracking catalysts and catalytic converters in the oil and automotive industries. REEs are also vital for many defense technologies, including precision guided munitions, targeting lasers, communications systems, airframes and aerospace engines, radar systems, optical equipment, sonar, and electronic countermeasures.

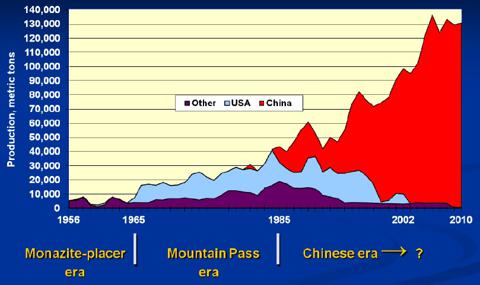

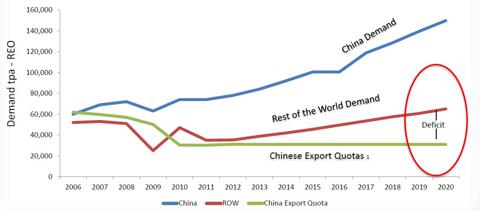

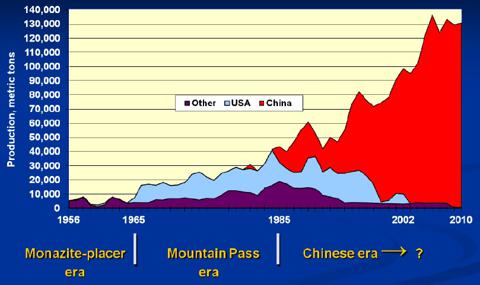

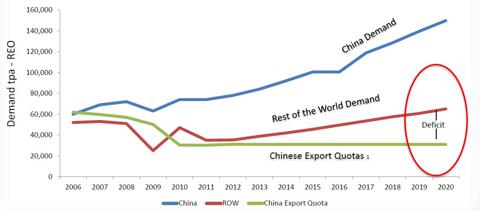

The supply of rare earths is dominated by China, which provides 92-97% of the world's production. However, China only has 48% of the world's known reserves of rare earths, according to the USGS Mineral Commodity Summaries. Due to growing internal demand, industry consolidation and stricter internal environmental regulations, China has imposed export quotas on rare earths. This creates two separate rare earth markets, one internal Chinese market and one for the Rest of the World (ROW). The Chinese export quota amount therefore defines the majority of REE supply for the ROW, and therefore its pricing.

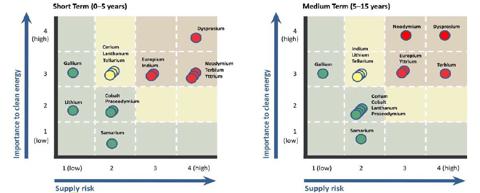

(click to enlarge)

Industry experts are trying to forecast the REE supply and demand figures, but this is not easy, as each rare earth element has different end uses and applications, and is produced in different quantities. This means that certain rare earths, including Neodymium, Europium, Terbium, Dysprosium, and Erbium are and will be in a supply deficit, while more abundant rare earths such as Lanthanum and Cerium will be in surplus.

(click to enlarge)

Combined REE supply and demand

Personally I think this chart is too positive, as China and the world economy as a whole are slowing down. However, China turning into a more consumer driven economy (as is the intention of national government at least) could mostly neutralize this slowdown regarding REEs.

Western LREE production isn't on

schedule and progressing as

planned. Furthermore China is regulating its production at the moment as it adjusts or closes

illegal REE mining operations. Therefore, my personal assumption is a more moderate growth in demand, and a moderate growth in supply as well.

Nevertheless, the dominance of China in the sector is overwhelming, and this already caused supply problems in the recent past for the rest of the world. This dependence is further reinforced by the current lack of rare earth production infrastructure and processing knowledge in the rest of the world. Also, because each rare earth deposit is unique and contains the various REEs in different proportions, individual elements are produced in different quantities. Besides this, end users require tailor-made rare earth oxides and other related products, therefore limiting flexibility for producers to stockpile or sell to random off takers.

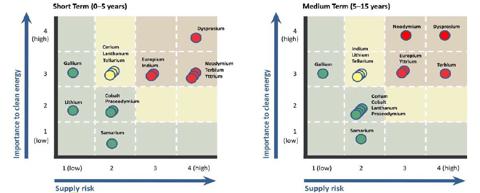

Some rare earths are likely to stay in short supply even though the total supply is forecast to exceed total demand by 2015. The US Department of Energy has identified 5 critical elements that are at a serious supply risk over the next 15 years: Dysprosium (DY), Terbium (Tb), Neodymium (Nd), Europium (EU) and Yttrium (Y)

(click to enlarge)

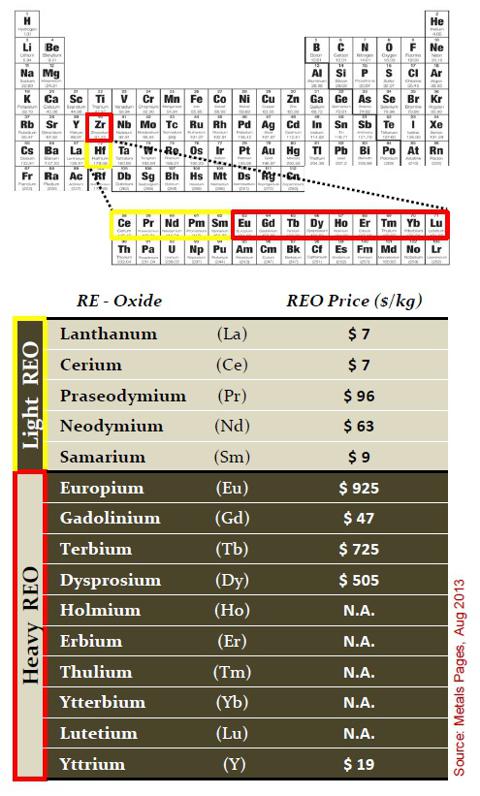

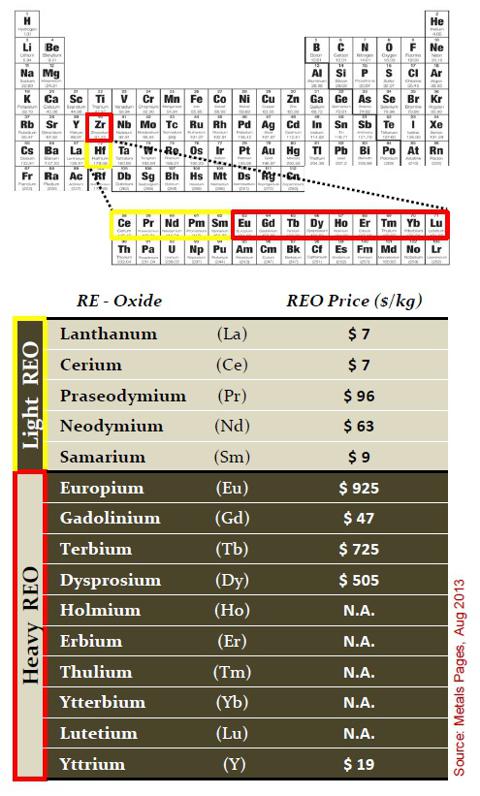

Most of these critical elements are part of the so-called "heavy rare earth elements" or HREEs as they have a bigger mass:

(click to enlarge)

As clearly can be concluded by seeing these prices, the heavy or critical elements are far more rare than the light rare elements. A recent increase in heavy rare element prices is caused by the Chinese government's

action to cut domestic rare earths' production, especially by targeting illegal miners, in conjunction with a perception of higher demand, especially in key markets such as Japan.

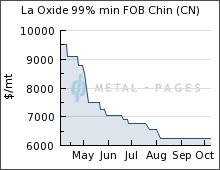

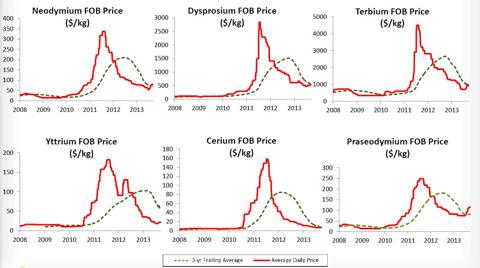

Typical development in HREE prices looks like this:

Dysprosium:

Yttrium:

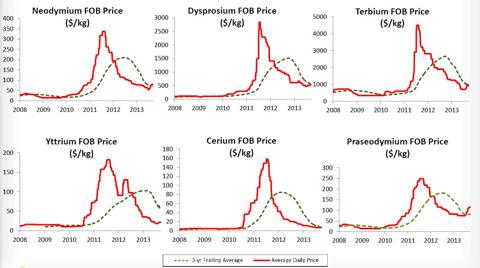

In LREEs the prices don't pick up as there is more than enough supply:

Lanthanum:

Cerium:

This marks the first time prices are increasing since the spike in 2011:

(click to enlarge)

After the Chinese export limitations in 2009 caused an escalation in REE prices never seen before as is seen in the last charts, which lasted into 2011, global concern rose since then about the sustaining availability of certain REEs, important to the Western Hemisphere. Two of these critical metals are Dysprosium and Terbium, both heavy REEs.

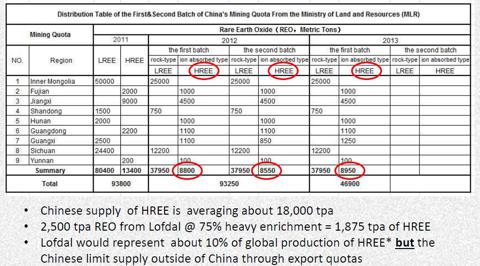

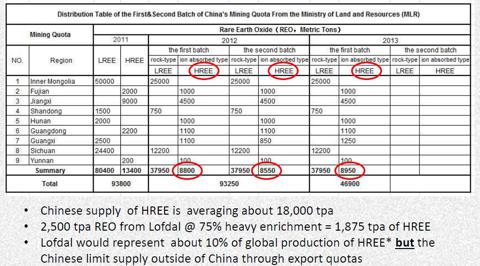

To get an idea of current production figures of China, have a look at this table:

(click to enlarge)

China produced 37,950 tonnes of LREE in H1 2013 and 8,950 tonnes of HREE in the same period. Only 3,874 tonnes of HREE were allowed for export to the rest of the world (ROW) in 2012. As China has an abundant resource base of LREEs but a relatively limited resource base of HREEs (it has only one very high percentage HREE mine, the Jangxi mine at 95% HREE), it is expected HREE output could be approaching its production limits, and China could become a net importer (

here and

here) from 2016 onwards.

There are doubts whether this is true, but I thought it was rather surprising to find out that the latest funding of Northland Minerals, one of the resulting top companies in my research, is

financed for a considerable part by a Chinese conglomerate named Conglin. The chairman of this conglomerate, Conglin Yue, is also director and largest shareholder (37.15%) of Northern Minerals. The conglomerate is directly linked to one of the biggest state owned miners of rare earths. Another researched company, Greenland Resources, also received a lot of Chinese interest on its REE project

lately. China wouldn't be doing this if internal supply wasn't any problem at all in my opinion. If they would be doing this just to maintain a stranglehold over the REE industry, they have to buy out all HREE projects globally.

I don't see this happening with several much larger and profitable North American and European initiatives whose governments would certainly block this as

considerable irritation about the Chinese way of handling their REE industry and exports already developed. Over a year ago, China started

stockpiling strategic reserves of REEs, this could very well be strategic for internal use, but also to halt a further drop in prices, one never knows what this country is up to. Very recently, China released other

purchase plans in connection to this. Bottom line is, LREE prices are stabilized now, and HREE prices have seen a slight increase since July 2013.

A lot of countries aren't too pleased with the whole situation, for example the Defense Department of the USA is already

considering starting to stockpile some critical metals, including a number of HREEs. Domestic production in the Western Hemisphere is also

encouraged and followed with a lot of interest, on all levels. There are only a few companies who have very good and profitable projects at the moment, and because China could become a net importer of HREEs in a few years from now, and HREE demand in the rest of the world will be relatively limited it will be a race against time to become part of a select group of new HREE producers. One of the companies who could very well win this race for first commercial production is Tasman Metals.

4. Company

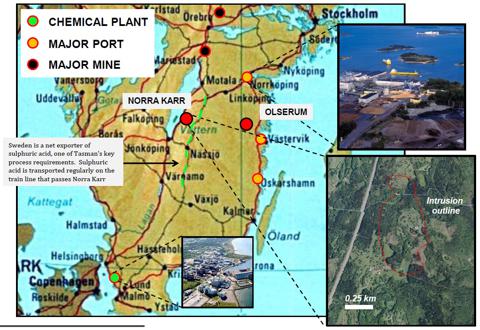

Tasman Metals is a Canadian based and Scandinavian focused mineral exploration company with extensive claim holdings in Sweden, Finland and Norway that are prospective for strategic metals, including rare earth elements and iron ore. The region is rightly regarded as the "home of REE" as many REEs were first discovered in Sweden, including cerium, erbium, holmium, lanthanum, scandium, terbium, thulium, ytterbium, and yttrium.

The Scandinavian region has a long and prosperous mining history, which has developed into a modern, highly mechanized and low cost region to explore and develop mines. The

Fraser Institute in its 2012/2013 survey ranked Finland and Sweden 1st and 2nd respectively for mining friendly countries/places to explore and mine. The Scandinavian countries offer good infrastructure, a skilled workforce, modern mining legislation with low or no royalties and big areas of relatively unexplored ground.

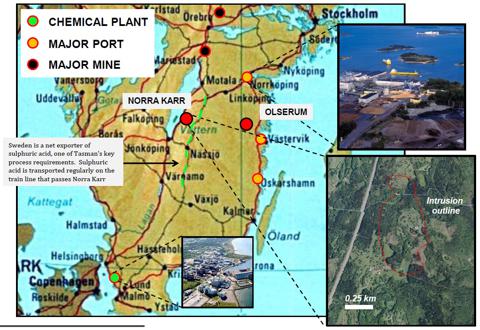

(click to enlarge)

Tasman Metals, Norra Karr project, Olserum project

The management is very experienced, with senior management having 17-50 years experience in mining and/or financing. They also have an authority in the field of REEs on their advisory board, Dr. Eriksen who advises Tasman Metals on various REE processing- and separation opportunities.

As of October 11, 2013, Tasman Metals has a share price of $0.72 and a market cap of $43.81M, with 60.85M shares outstanding. The company has $6.5M in cash and is debt free.

(click to enlarge)

Share price over 3-year period

5. Projects

A. The Norra Karr project

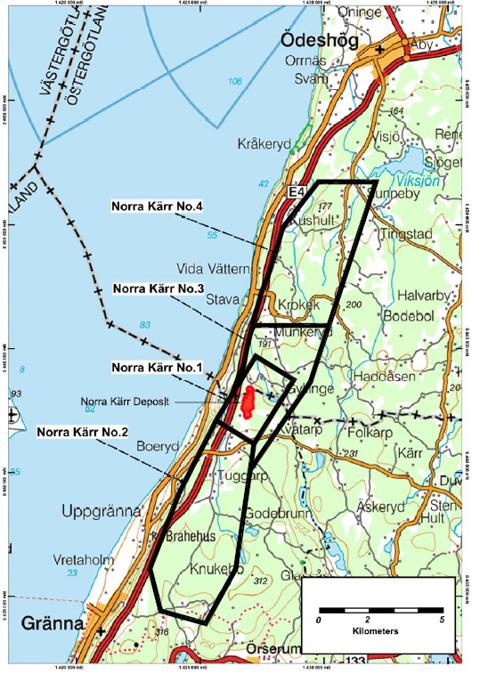

The Norra Karr project is located in southern Sweden, 300 kilometers south west of the capital Stockholm and lies in mixed farming and forestry land. The site is well serviced by power, roads and water allowing all year round access, minimizing the need for offsite infrastructure to be built by the Company. The claim area is much bigger than the deposit itself, and is supposed to have a lot of upside potential:

Tasman Metals, Norra Karr claims

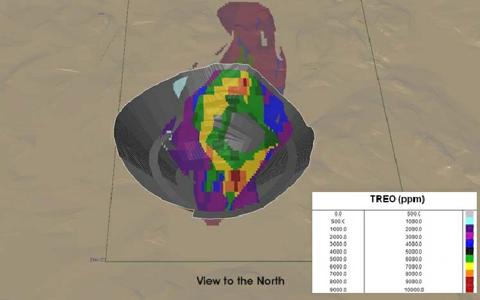

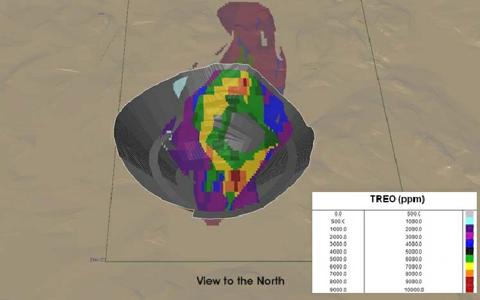

This project consists of a very near surface, rare earth deposit which is approximately 300m wide by 800m long at surface, and covered by an average of less than 1m of soil, which makes it a perfect candidate for open pit mining:

(click to enlarge)

Norra Karr, open pit visualization

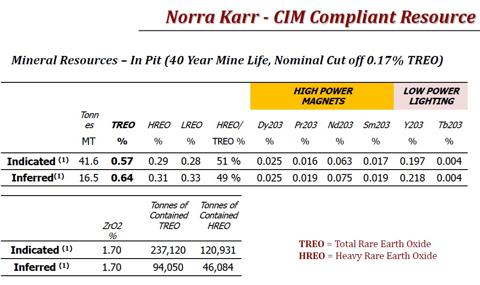

Resource estimate

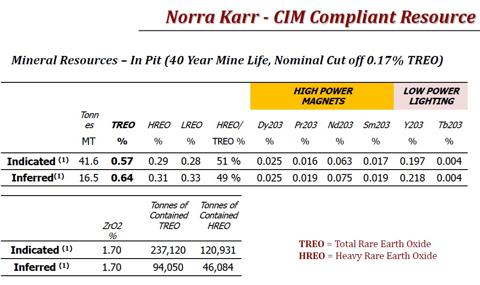

This is the resource estimate on the Norra Karr project:

(click to enlarge)

(click to enlarge)

Norra Karr project, major road within 0.5km

Tasman Metals completed a very positive Preliminary Economic Assessment (PEA) on the Norra Karr project on July 9, 2013, with key metrics a very low capex of $266M, a very high after tax IRR of 45%, a good after tax NPV of $1464M and this is all based on one of the highest percentages of HREEs globally, 51% HREEs of total rare earth oxides (TREO). The project also benefits from Zirconium oxide as by product, enhancing the business case.

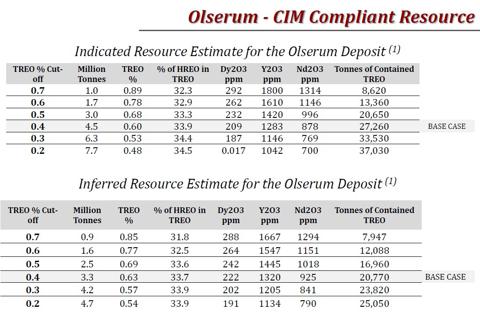

B. The Olserum project

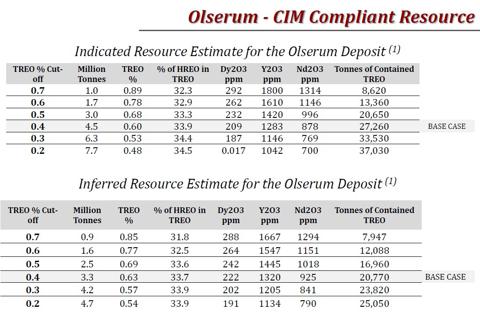

This is the other rare earth deposit of the company, although it is lower grade in HREE and has a smaller resource, it is still one of the better HREE resources in the world with 33.9% HREEs and 48,030 tonnes TREO and could easily be developed because of its small size.

Resource estimate

On June 12, 2012, Tasman Metals released an updated resource estimate for the Olserum project:

(click to enlarge)

C. Other projects

Tasman Metals also has a number of prospective iron ore claims in Sweden and Norway, and only

very recently acquired 6 interesting tungsten projects which are secured by 7 exploration claims totaling 3,680.4 hectares in size. All projects, including a former tungsten producing mine, have extensive historic information including drilling, production and metallurgical data, and are supported by excellent road, rail and power infrastructure.

Tungsten is an essential industrial metal that faces the same resource security challenges to REEs, with a Chinese supply monopoly of 80%, and strongly growing demand.

Based on its economic importance and high risk of supply disruption, tungsten has been named a "critical" metal in recent British Geological Survey (BGS) and European Commission (EC) publications. Tungsten is an essential industrial element with hundreds of end-use applications. It has the highest melting point (3,410°C) and highest tensile strength of all pure metals, and is therefore highly sought after for drilling and cutting equipment, specialty steels and aerospace applications.

Since 2008, Chinese domestic demand has exceeded its own supply, resulting in a near doubling of price for tungsten concentrate over this period, and a gradual increase in total traded volume. Tungsten demand growth has consistently outperformed GDP growth, so Tasman Metals did a very interesting acquisition in my opinion with these projects, which contain on average 0.3% tungsten mineral (WO3) which is just above average. But for now all focus is directed towards the Norra Karr project.

6. Peer Comparison

Since I became curious what would be the best REE junior, I decided to perform an extensive peer comparison. As the company is a junior explorer, producers like Lynas (

LYSCF.PK) and Molycorp (

MCP) were left out. These two companies are currently ramping up production (or starting up production, determined by whoever is asked as much is unclear yet) of predominantly LREEs, therefore I expect them to reach full commercial production before the end of 2015. This practically rules out all other initiatives predominantly based on LREEs, as Lynas and Molycorp will produce enough to fulfill most demand on LREEs at this time for the rest of the world (ROW).

Molycorp, Phoenix project

Therefore, the only initiatives economically viable are projects predominantly based on HREEs, and the companies I chose are exploring exactly this kind of projects. However, I decided to include one exception, and this is Rare Element Resources . This company has by far the best business case on LREEs in my opinion, and should Lynas or Molycorp experience sustaining problems ramping up production heading into 2016, this junior could be a real threat to them. This is my short list, in random order:

- Avalon Rare Metals (

AVL)

- Quest Rare Minerals (

QRM)

- Tasman Metals

- Rare Element Resources (

REE)

- Northern Minerals (no US ticker, ASX: NTU)

- Texas Rare Earth Resources (

TRER.PK)

I start describing the basics, and go deeper step by step, producing calculations, assumptions or estimations if necessary. After presenting all results in various tables, the comparison will be summarized in the last table, ranking all companies. It is then when I would like to analyze the companies and draw conclusions, and just make remarks in between steps here and there to clarify things.

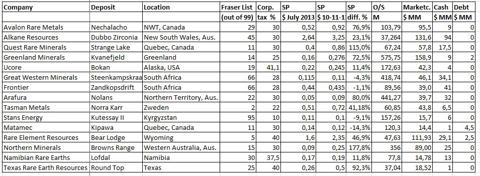

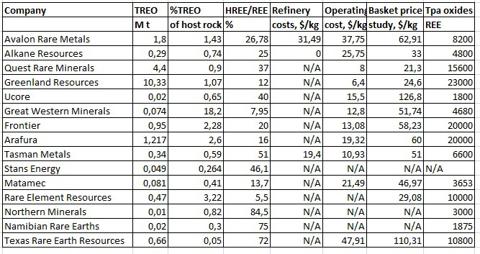

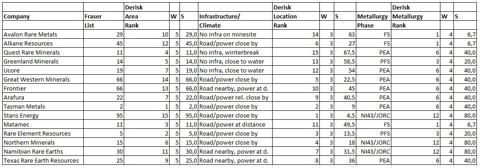

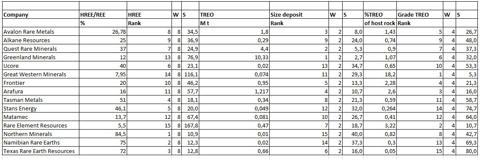

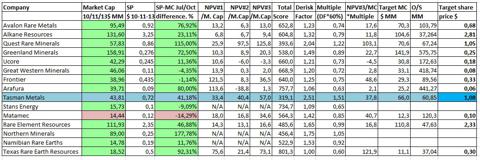

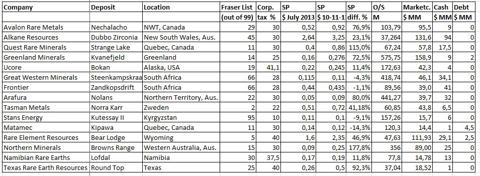

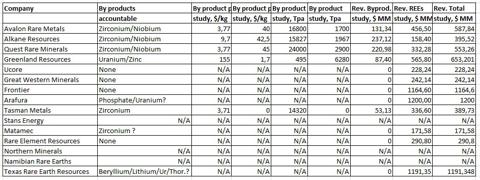

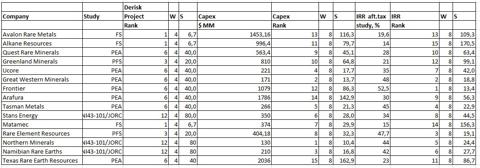

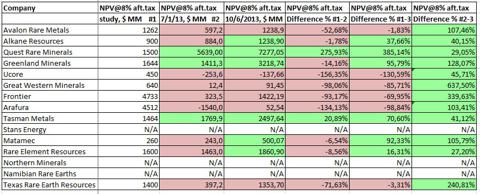

Basic metrics:

(click to enlarge)

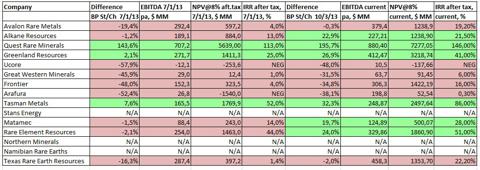

The share price of July 2013 is shown as it is a key indicator in some of my comparisons.

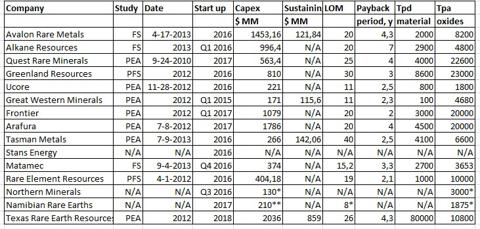

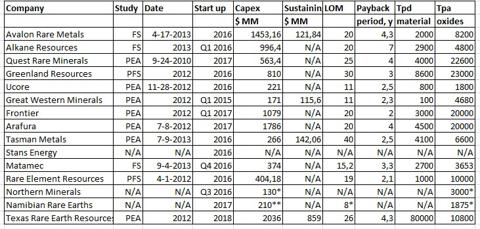

Study part I:

(click to enlarge)

* estimated by company **estimated by the author

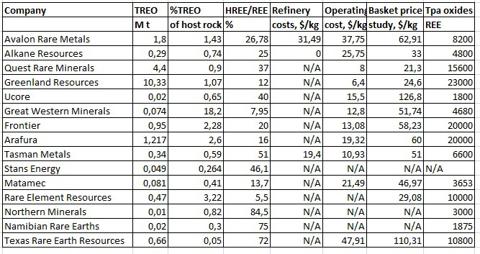

Study part II:

(click to enlarge)

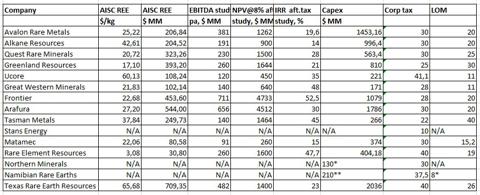

Study part III:

(click to enlarge)

The all in sustaining cost (AISC) is a metric I need to be able to perform calculations on adjusted NPVs and IRRs, and I was in turn able to calculate AISC by first calculating byproduct revenues, and a lot of EBITDA figures as well, as these were not present in a lot of studies:

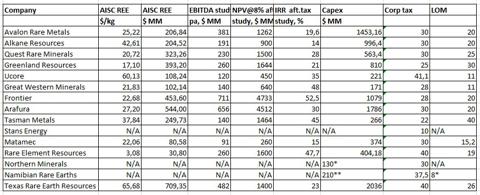

Byproduct Calculation:

(click to enlarge)

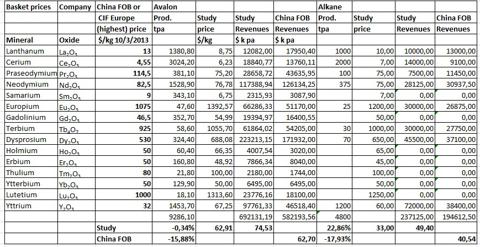

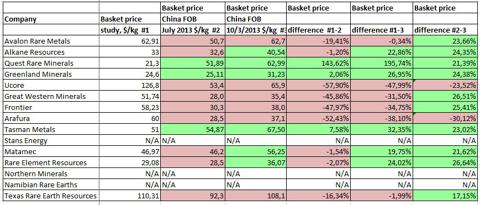

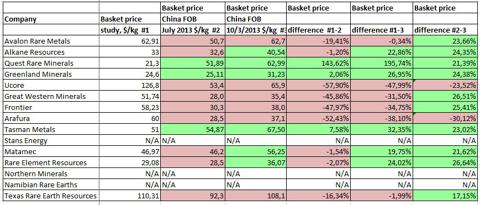

A very important issue for rare earth explorers (and miners) are the prices of REE oxides. As shown before, these prices can fluctuate a great deal and are prone to developments in China. Therefore it is crucial for companies to use conservative prices in the business cases for all to be produced REEs. As every company has its own unique combination of grades and REEs, picking the right composition of all prices (called basket price) could be decisive in a study when fast-tracking towards mine financing, and ultimately production.

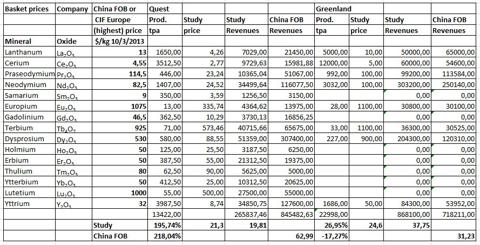

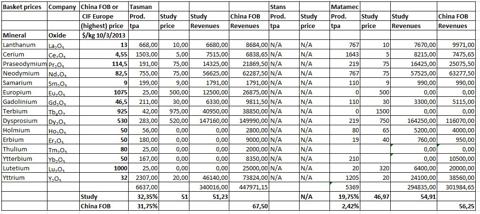

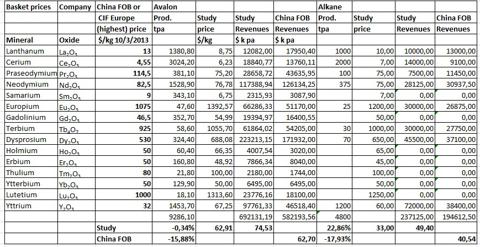

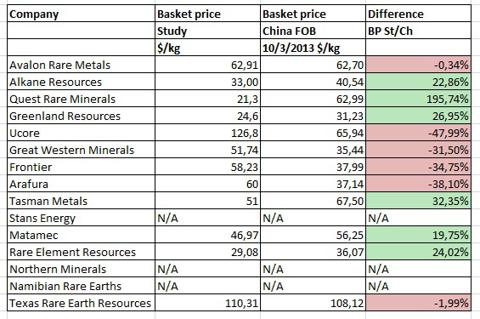

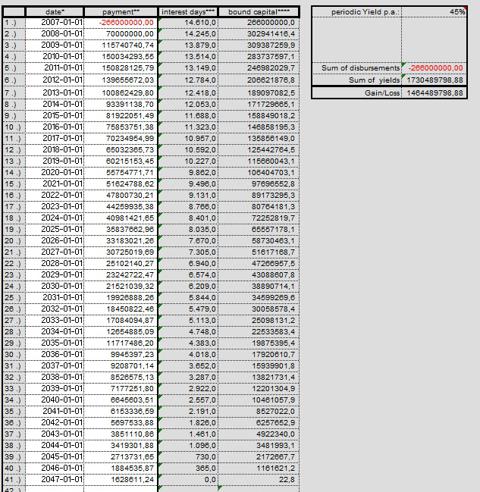

Next up I compare all basket prices of the mentioned companies, at study level to price levels of the multi year low of July 2013 (I was able to retrieve them by a free trial subscription at Asianmetal.com), and study level to today's price levels (10-3-2013, latest prices Metal Pages). This will show the consequences of determined basket prices. I will show 6 random cases in detail to visualize the calculation on the comparison of study level basket prices to today's price level basket prices:

Avalon and Alkane:

(click to enlarge)

Quest and Greenland:

(click to enlarge)

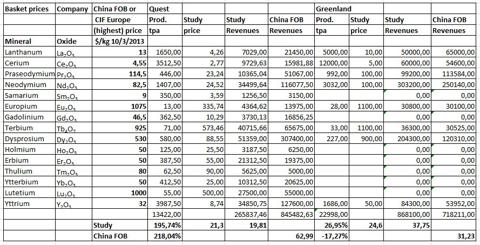

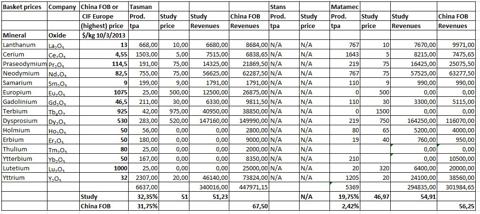

Tasman and Matamec:

(click to enlarge)

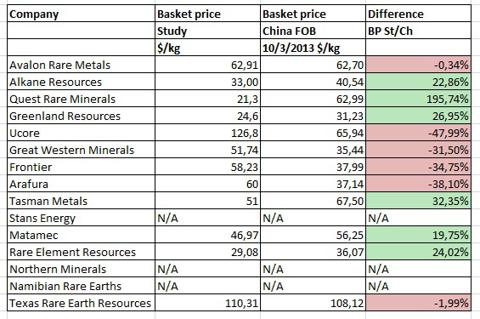

Difference between basket price study and basket price China FOB 10-3-2013:

(click to enlarge)

For example, the impact of Quest using price levels before the run up in 2011 is clearly visible, which were much lower back then. Therefore this company has a big advantage in this department at the moment, and I expect some fireworks when its PFS comes out in Q4 2013.

(click to enlarge)

Quest Rare Minerals: Strange Lake project

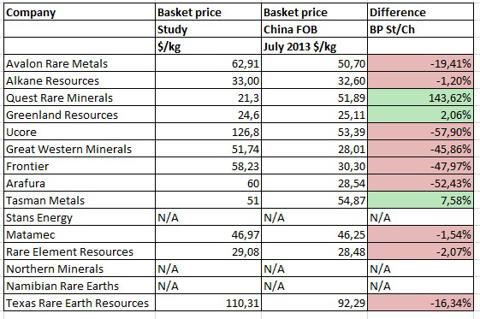

Difference between basket price study and basket price China FOB July 2013:

(click to enlarge)

This table shows the pricing used by the companies to determine their business cases. For me it is a good indication who is able to price conservatively and who is not.

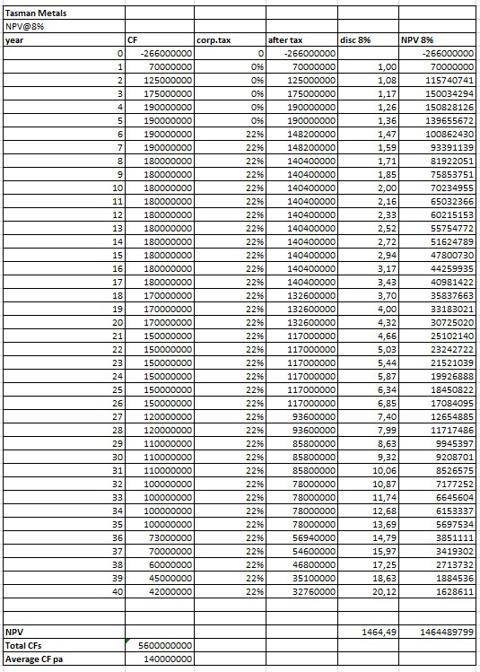

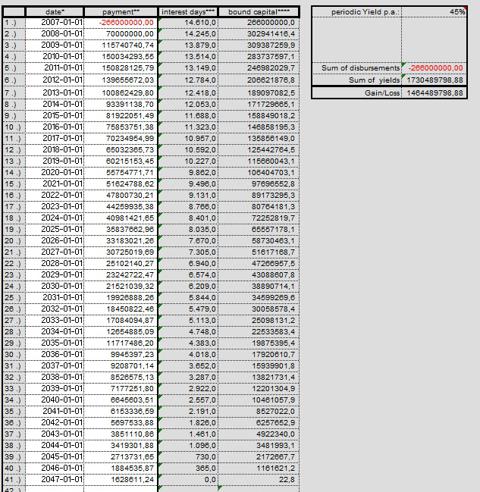

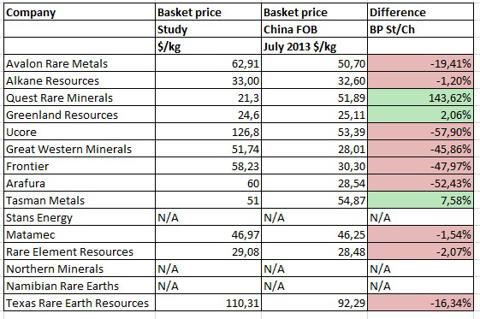

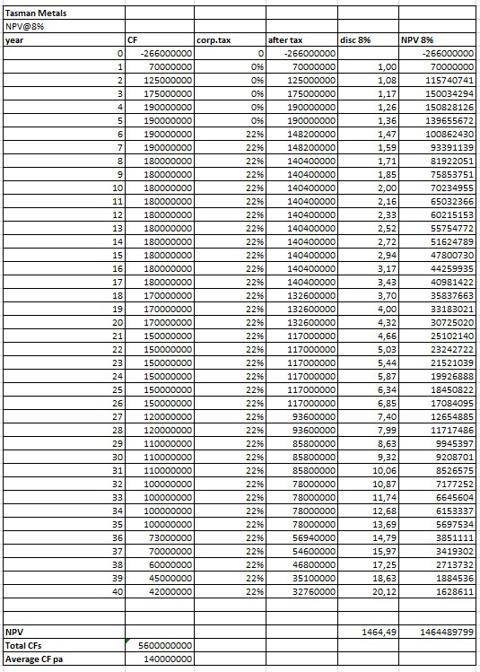

I calculated these adjusted basket prices into corresponding NPVs and IRRs to measure impact of changing basket prices on business cases. First an example of a NPV and IRR simulation of the study business case of Tasman Metals to get the cash flows and taxes right:

NPV simulation:

(click to enlarge)

IRR simulation:

(click to enlarge)

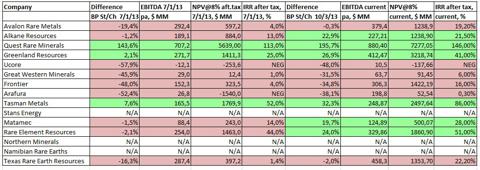

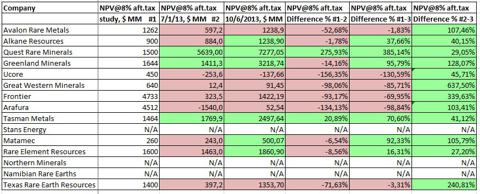

This simulation had to be done for every company. After this it was possible to adjust annual cash flows caused by the already mentioned and calculated changes in basket prices for July and October 2013. This results for all companies in the following table:

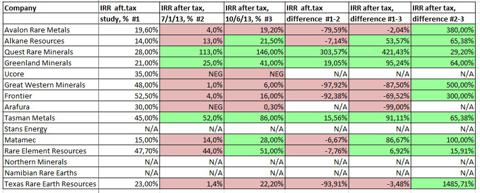

(click to enlarge)

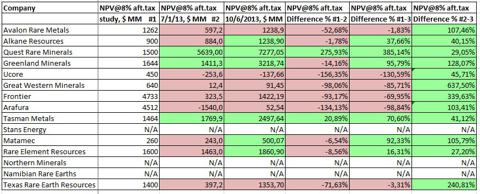

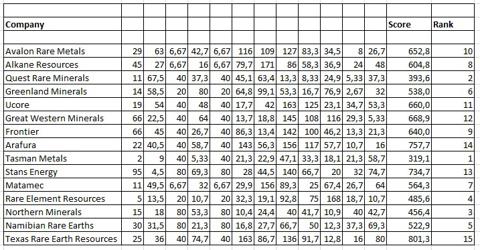

The results for NPV differences for the three different basket price level periods (study, July, October) are in the following table:

(click to enlarge)

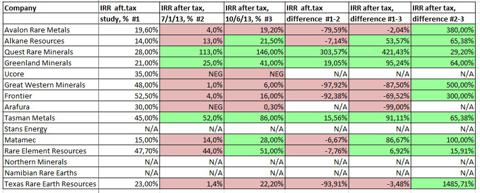

The results for IRR differences for the three different basket price level periods (study, July, October) are in the following table:

(click to enlarge)

The results for the three different basket price levels itself over the periods (study, July, October) are in the following table:

(click to enlarge)

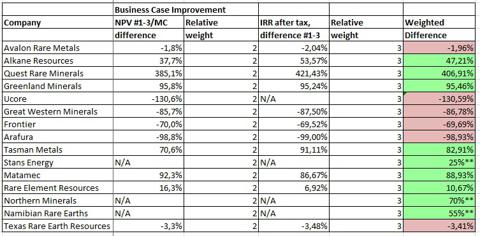

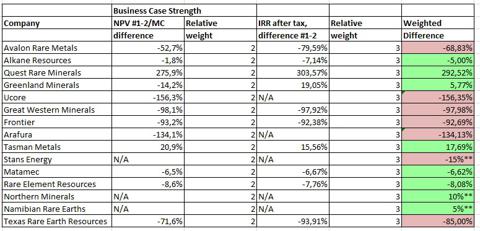

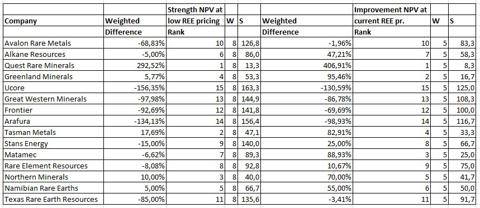

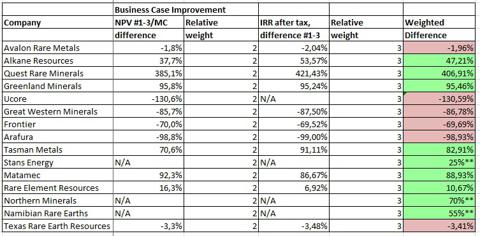

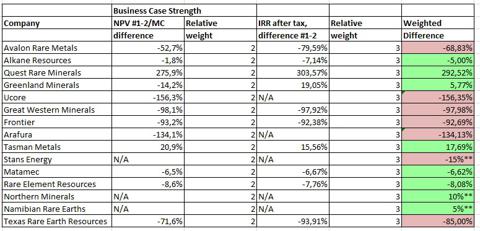

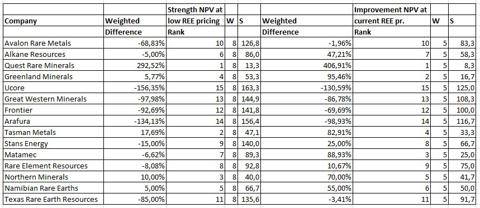

These three tables combined are resulting in two tables which I named "Business Case Improvement" and "Business Case Strength":

(click to enlarge)

Business Case Improvement: Study vs. October 2013, **=estimated by author

(click to enlarge)

Business Case Strength: Study vs. July 2013, **= estimated by author

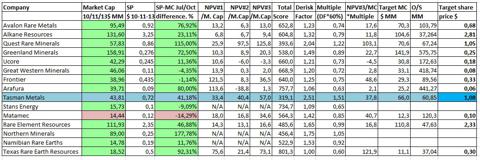

The results of these two tables are part of my comparison. Right now a quantification will be made of 12 parameters which I assume vital to determine the strengths and weaknesses of the companies :

- Area derisking, based on the position a country or area has on the Fraser List

- Location derisking, based on available infrastructure, power, accessibility, climate

- Metallurgy derisking, based on the amount of work being done to define the metallurgy of the rare earth minerals. About three years ago this was a very important issue as it was difficult to "crack the code" on each host rock to be able to retrieve the REEs, nowadays there is much more knowledge present, metallurgy could still be a problem but not as big as before. Companies just work on it and get it done, but optimization seems to be more the current issue. This is of course important to the business case, determining the profitability by optimizing the recovery grade. As this derisking is not at all clear and objective information, I connected this to the phase of economic studies

- Project derisking, also based on phase of economic studies

- Environmental/health/permitting issues, for example REE deposits often have radioactive radiation which causes health issues which requires very strict permitting

- Capex, based on initial capex, or the financing required to build the mine, ready for commercial production

- IRR

- Business Case Strength

- Business Case Improvement

- HREE percentage of resource

- Size of deposit

- Average grade TREO of host rock

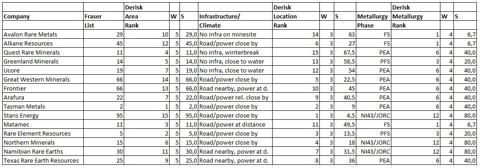

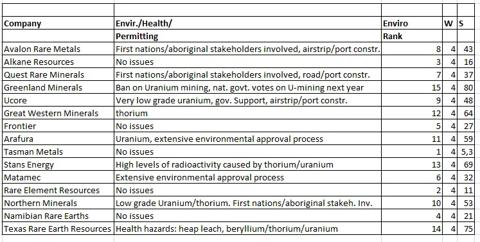

I attributed an assumed relative weight to each parameter (for example the height of the capex is very important as financing these days is very difficult, so capex has weight factor of 8, as opposed to the size of deposit with a weight factor of 2, being less important because HREEs aren't really needed in massive quantities), and tried to calculate a score for each company on a certain parameter. This was not easy as some parameters are very difficult to quantify, doing justice to the true value of the parameter for each company relative to the other. In order to do this as properly as possible, I used a rule of thumb of a maximum score per parameter is approximately 20 points x weight.

This results in the following tables, the lower the score (S is score, W is weight) the better:

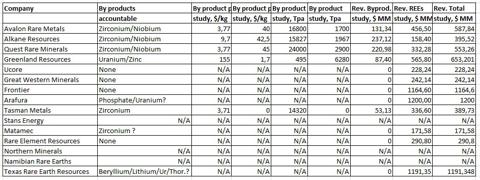

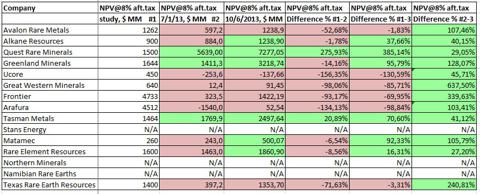

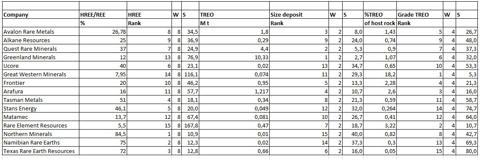

Area derisking, Location derisking and Metallurgy derisking:

(click to enlarge)

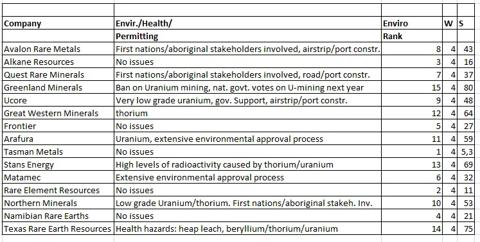

Environmental/health/permitting issues:

(click to enlarge)

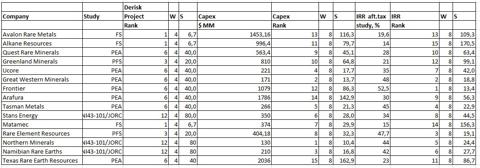

Project derisking, Capex, IRR after tax:

(click to enlarge)

Business Case Strength, Business Case Improvement:

(click to enlarge)

HREE percentage of resource, Size of deposit, Average grade TREO of host rock:

(click to enlarge)

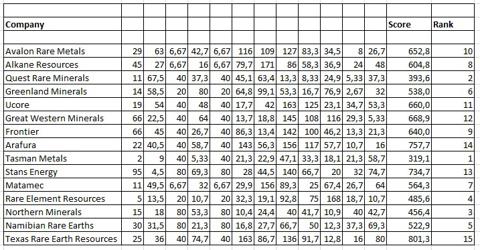

These tables generated scores for each parameter for each company, when all these scores are put together and added, a ranking based on total scores is derived:

(click to enlarge)

First comments:

To my surprise, Tasman Metals appears to be ranked first by quite a margin to Quest Rare Minerals and Northern Minerals as it seems to have the only project without major flaws. But as mentioned, when the PFS of Quest comes out in Q4 2013, I expect it to probably have the highest IRR, bringing it closer to Tasman. As Quest has planned a very high throughput, a bit too high in my opinion, it probably could be downsized into a more efficient operation, targeting more high grade portions, maybe improvement of recovery and therefore saving on capex and increasing IRR even more. As Northern Minerals is concerned, I had to take into account not having an economic study released, generating high scores on metallurgy as well.

(click to enlarge)

Namibia Rare Earths, Lofdal project

The same is valid for Namibia Rare Earths, but the big difference is Northern is working towards a PFS in 2014, gaining some decent score by that, as Namibia has no short-term ambitions to release a study but wants to work on its metallurgy first, which could indicate recovery issues. Rare Element Resources has a very solid project in my opinion and according to my comparison, only hampered by its low grade HREEs. I don't really consider this a show stopper at this moment as its case holds up pretty nicely during low LREE prices, so the leverage on this company by LREEs isn't considerable, and therefore it is able to compete very well with most predominantly HREE junior explorers. I think there could be room for another LREE producer, as Lynas and Molycorp aren't performing too well.

Analysis peer comparison regarding strengths and weaknesses:

- Avalon Rare Metals: It is very advanced into the FS phase, it has a solid after tax NPV@8% of $1,262M, but a very expensive initial capex of $1.45B and a low after tax IRR of 19.6%. The management wasn't able to raise funding by debt, and are trying now to get its capex together by equity, which is completely impossible for this kind of amount these days in my opinion, especially after banks didn't provide anything yet which normally is a starting point (rule of thumb: 2/3 debt, 1/3 equity for capex). The study basket price for HREE is 25-30% higher than current. The deposit is located in the middle of nowhere, 100km from power or infrastructure and last but not least under a lake. The company has its own refinery planned, and the project has a zirconium concentrate byproduct.

(click to enlarge)

Avalon Rare Metals: Nechalacho project

- Alkane Resources: This company is also very advanced into FS phase, has an expensive initial capex of $996.4M, and a low after tax IRR of 14%. The company has planned its own refinery, and the project has a zirconium concentrate byproduct. The financing program started in Q1 2013, but generated no results yet. It could be able to use some cash flows from Tomingley Gold Mine which commences production in Q1 2014. Construction start is planned in Q3 2014, the start of production is planned in Q1 2016.

- Quest Rare Minerals: It is releasing a PFS soon in Q4 2013, it could scale down its large operation and already has modest capex, and by updating the basket price and improving on metallurgy since 2010, the IRR could be spectacular. The only disadvantage is a very northern location in the middle of nowhere, therefore having to build a lot of infrastructure from scratch and possibly needing a winter break for operations as it gets too cold (200 kilometers Northern of Labrador Iron Ore which needs this kind of break). I am curious if this issue gets sufficiently addressed in its upcoming PFS.

- Greenland Minerals: Its project is already fairly advanced by a PFS, the business case is holding up nicely at low basket prices, and its project has solid average figures on basics. A big disadvantage is the current ban on uranium mining at Greenland, as this is an important part of the Kvanefjeld project it could maintain a permanent obstruction. But with a newly elected government this year which is supportive about lifting this ban, things look brighter for Greenland. Uranium does cause a great deal of permitting issues so it isn't an easy road. Another issue is a location in the middle of nowhere, but directly at deep water. The climate at the specific location is moderate, as the project is located on the southern tip of Greenland.

(click to enlarge)

Greenland Minerals: Kvanefjeld project

- Ucore: It is a small and low capex project, high percentage HREE (40%), located at the coast of Alaska at deep water but with no infrastructure or power present. It has a lot of local and government support but one big disadvantage: as its basket price level is much too high in its PEA, they have some serious recalculations to do, as the project isn't profitable at the moment (only company to do so at current REE prices). However, this should be possible as percentage, grade and size are enough to obtain a decent business case.

- Great Western Minerals: As a former Thorium mine, radioactivity will always be an issue. The basket prices are calculated too high, in theory the project has a very low capex and high IRR in study. Nevertheless, the company is supposed to have a real REE gem of a project in its hands, at a low grade HREE (7.5%) but an extremely high percentage TREO (18.2%, average is about 0.5-1.0%). This should be enough for the company to be able to recalculate AISC to record low levels in my opinion, and of course its mine should only need some refurbishments, again, in theory. However, the project Steenkampskraal (SKK) is located in South Africa, and this country is a guarantee for trouble. SKK was supposed to be up and running in Q4 2011 (reportedly so in 2010, main reason for me to buy the stock in this period, was a bit naive about South Africa back then as well) but since then the keywords are delays and cost overruns. The mine is now scheduled to be in operation at the end of 2015, but I wouldn't bet on it.

- Frontier: This is also a remarkable project at first sight, maybe a high capex figure at $1079M but the highest theoretical after tax IRR (52.5%) of all analyzed companies. Teamed up in a JV with Korea Resources Corporation (KORES), it has a nice off take partner for the first 31% of production. As its basket price is calculated in 2012 just like Great Western's, the business case isn't very profitable at the moment, but the fine deposit should be profitable as well, it needs some recalculation. As a very recent

news release stated (10/14/2013) their flowsheet is improved so their basket price improves from $36/kg to $44/kg, improving their business case which, however, is still well below PEA projected levels ($58.23). Biggest disadvantage is the South African location which in my view makes it a no go altogether.

- Arafura: Its Nolans project has a colossal capex of $1,786M, it is not profitable at July REE prices and barely at today's prices, it has an expected difficult permitting process because there's uranium in the rocks as well. A lot of average scores on other parameters bring Arafura almost at the bottom of our ranking. I think as its average grade TREO is above average and % HREE is just enough, they should be able to gain some places if they could bring down its capex considerably and again recalculate its basket price.

(click to enlarge)

Arafura: Nolans project

- Tasman Metals: This company doesn't have any weak points, it is located in one of the best countries globally to mine, has low capex, high IRR and high percentage HREE, and makes good progress on all aspects of its project now. To diversify into tungsten is a very interesting move, as tungsten is a critical metal as well, just like some HREEs. The only disadvantage could be its time schedule, as Tasman is planning to release a PFS in Q2 2014, and other companies already produced a PFS or FS and are progressing towards financing activities. However, all these further advanced companies have serious disadvantages which will make life (very) difficult for them to actually get financing or be competitive on HREE territory: (very) high capex: Avalon, Alkane, Greenland; low percentage HREE: Rare Element, Matamec, Greenland; low IRR: Matamec, Greenland; difficulties permitting: Avalon, Greenland, Matamec.

- Stans Energy: Back in 2010 the company reported Kutessay II being operational in Q4 2011 as it was the former REE mine of the Soviet Union, only refurbishments were needed. This was actually one of my reasons, together with Stans being the only HREE junior out there in 2010, to buy this stock (I didn't know the Fraser List back then). Since then nothing much happened, except for a resource estimate being published. As they are located in Kyrgyzstan which is ranked number 95 (out of 99 countries and areas) on the Fraser List of mining friendly countries, this company is a no go. Add to this the very radioactive deposit caused by thorium and uranium, and a considerable amount of native (or employed by Russia, hard to tell) directors added to the management and board over the last two years, and it will be clear this could be the most speculative stock of them all.

- Matamec: Besides its low after-tax IRR (15%), low percentage HREE (13.7%) and possibly extensive and time delaying permitting process, it is well advanced by producing a FS in Q3 2013 and has been chosen by Toyota for an off take agreement. What this could be worth only time will tell, since the FS release on September 4, 2013, presenting the disappointing figures, the Matamec stock plummeted and lost over 50% of value in a few days.

- Rare Element Resources: Bear Lodge is actually a very good project with only one weak point: the HREE percentage is very low (5%), so it isn't able to compete on this specific area with the others. But since other LREE producers Lynas and Molycorp are having all sorts of

troubleslately to either commence

full production or make profits (and not having to fight

class action lawsuits about lost investments), I don't rule out all chances for Rare Element Resources to join the LREE ranks. Especially since Molycorp is delivering most production to fully owned subsidiary Neo Materials which is located in China, not much to the delight of the USA.

- Northern Minerals (no US ticker, ASX: NTU):This company has probably all it takes to seriously challenge Quest for the second spot when its first economic study comes out. The company has no weak points except its deposit contains low grade uranium and thorium, and First Nations are involved in the project, complicating permitting processes along the way. Browns Range isn't the only very high percentage HREE (84.5%) project they have, the recently being explored but since long recognized John Galt project could be even more profitable. One detail I am not very fond of are the big Chinese interests in these company (37.15%), which backed a $54M financing for the company. This probably means this company will be taken out long before it gets into production, at bargain levels. This could be a waste as I consider this project one of the best HREE projects in the world, for sure the best in Australia.

Northern Minerals: Browns Range, Wolverine project

- Namibia Rare Earths: Lofdal is another small, low capex and very high percentage HREE (75%) project, also lacking an economic study just like Northern Minerals. Only problem for its business case could be the low grade TREO (0.3%) which is about one third of Northern Minerals'. Namibia is not Australia, and it ranks in almost all departments just a bit lower than Northern, so therefore rank 5 for this company. I don't really get why it deliberately doesn't want to start with an economic study, it could run the metallurgic testing program simultaneously as is relatively standard, but as mentioned earlier this could indicate difficulties on recovery.

- Texas Rare Earth Resources: With the highest capex of all ($2036M), a moderate after tax IRR (23%), by far the lowest grade TREO (0.05%), all kinds of radioactive (uranium and thorium) and extremely toxic (beryllium) minerals present, accompanied by the luminous idea of the management to make this project economically viable by heap leach, combined probably generating all kinds of permitting problems in Texas, this project will very likely never be built at all, and therefore this company ends last unfortunately.

(click to enlarge)

Texas Rare Earth Resources, Round Top project

7. Valuation

There are different methods to value an explorer. As I am interested in a short term and longer-term valuation, and to rule out as much speculation as possible, I will use a combination of extensive peer comparison, this year's price action regarding NPVs and sum of parts. By doing this, I show why I do think Tasman Metals is undervalued at the moment. As always, there is also a downside risk to every investment thesis as well, and I would like to elaborate on this first.

A sector like rare earths has its own downside risks, as I mentioned in other paragraphs. Even an investment in Tasman Metals has downside potential, no matter how good its project is. HREE prices still have a big impact on the junior sector as we have seen, and as they have come up recently, they could come down again as well since no one knows for sure what China is up to. But signals are there that prices are very likely to stay above July 2013 levels, as I described earlier. Assuming early July 2013 levels as the bottom, the Tasman share price at that moment was $0.51, so a possible theoretical downside exists of 29% compared to today's (10/11/2013) share price of $0.72, based on HREE pricing alone.

As Tasman didn't have its PEA out back then (its share price increased to $0.81 from $0.57 in two days directly after the PEA came out), the company has been substantially derisked since then by becoming a standout junior with a very solid business case. A limited problem could be a bad performance of REE sector flagships Molycorp and Lynas, dragging everything down with them, but since they are dependent on LREE pricing, and a number of HREE projects advancing at the same time with much more profitable business cases, a separation between these two groups of REEs should be inevitable regarding market perception in my opinion.

Taking everything into account, it doesn't seem too conservative to me to state a possible downside share price of $0.55, for a downside risk of 23.6%.

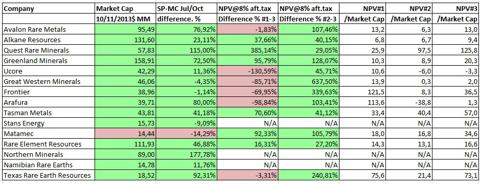

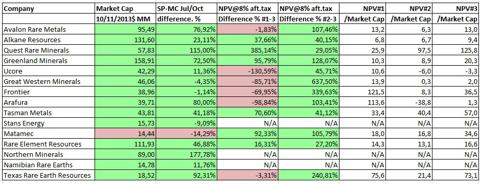

Regarding price action I would like to analyze what the developments were of NPVs based on REE basket prices at July 2013 and at October 11, 2013, compared to the developments of share prices in this period of time. First up to get things clear, a table used earlier about NPV developments:

(click to enlarge)

After this comes a table comparing share price action and NPV development:

(click to enlarge)

Looking at column 3 (share price or market cap development July-Oct 2013), and comparing this column with the latest 3 NPV columns (NPV study/July/Oct), it is clear there have been some remarkable price actions in this period. It doesn't seem to matter that Arafura's NPV still is way below study levels, its share just rises with 80%. Avalon's NPV has barely reached NPV study levels again, has considerable problems on financing its project, but nevertheless its share price has soared 72.92%. Rare Element Resources, whose NPV values have been more or less the same, rose more than Tasman, whose business case however steadily improved in the same period of time. Investors at Quest apparently seem to have woken up all of a sudden in July, the NPV didn't rise that much since then, but the share price had some catching up to do, compared to the drastic increase in NPV value (NPV study vs. NPV July/Oct) caused by the tripled study basket price since 2010. Matamec is even more curious, although the FS figures disappointed investors, its business case improved considerably regarding study NPV levels, after tax IRR almost doubled from 15% (study) to 28% (current REE prices)

As we have seen in the peer comparison, Rare Element Resources and Quest are some of the best, but it doesn't really make sense that Tasman Metals as best in class HREE junior lags behind in share price increases. In my opinion this current mispricing has been caused by a market failing to distinguish a few high quality projects from a lot of mediocre to outright bad projects, dragging down everything to very low levels. The very speculative nature of all REE projects in 2011 helped them to soar, the lost hype sentiments today brought a considerably derisked sector down as a whole as well unfortunately, undeservedly so in my view. When the markets starts to pay enough attention to under covered quality companies like Tasman Metals, further progressing and derisking nicely at the moment, and are able to detect failing competitors, I expect a more fair valuation to take place soon. With REE prices having bottomed out at the moment and on the rise again, coverage probably will intensify as REE juniors became more attractive almost instantly. Now is the chance to pick up the very few high quality companies in the HREE space on a misplaced discount.

Based on price action of comparable peers (market cap versus NPV) alone, Tasman would have some 30-80% upside potential.

Because of this wide range, price action shouldn't be the single source to determine fair value in my opinion. Therefore I thought of a concept where the peer comparison total score could work as a derisk factor, and therefore could be used as an adjustment multiple for the NPV/market cap ratio. Normally, for producers this ratio is 1-1.2, for near-term producers 1.2-1.5, and for companies in a PFS/FS phase 1.5-2.0. The REE juniors we are dealing with here are obviously so speculative, that they have theoretical ratios up to 125.8 based on today's REE prices. Tasman itself also has a theoretical ratio of 57 which is harsh in my opinion.

Therefore, I calculated the derisk factors by calculating how much more risk every company has regarding Tasman (assumed inverse equal with score). After this I calculated the adjustment multiple by discounting the derisk factor by 40% to be conservative. This results in an adjusted NPV#3/market cap/multiple, and this results in turn in an adjusted or target market cap. Divided by the outstanding shares a risk adjusted target share price is derived for most companies:

(click to enlarge)

Taking into account a current share price of $0.72 (10/11/2013), based on 60.85M shares we get a short-term target share price of $ 1.08, for an estimated profit of 50% at this moment, indicating an asymmetric risk/reward ratio as far as I am concerned.

For investors with more patience, in 2017 when Norra Karr should be in commercial production, Tasman could be really rewarding. I use a very conservative 50% discount on an already conservative low REE pricing scenario, as the China factor adds uncertainty to the REE universe, and 2017 isn't around the corner.

The target share price is estimated at the lower REE basket price of July 2013 (NPV@8% of $1769.9M) with assumed dilution up to 148.85M shares outstanding (capex $266M > 2/3 debt + 1/3 equity = $88M equity at an assumed SP of $1.00 = +88M shares dilution) at NPV x 50% discount / O/S = 1769.9 x 0.5 / 148.85M = $5.94 for an estimated profit of 725%. At today's prices the NPV@8% would be $2497.64M, resulting in an estimated target share price of $8.39 for an estimated profit of 1065%.

(click to enlarge)

Tasman Metals: drilling at Norra Karr

8. Catalysts & Risks

As Tasman Metals has very good fundamentals, actually on average the best of all REE-juniors as far as I am concerned, it is just a matter of fast-tracking towards production in 2017 as the project is already considerably derisked by the latest PEA.

First positive catalyst could be better than expected latest results of ongoing metallurgy testing its pilot plant, to be expected in November/December 2013.

After this it is expected to finalize the conversion of Indicated resources into Measured resources by an updated NI43-101 resource estimate, in Q1 2014.

Next up is the release of a Pre-Feasibility Study (PFS), scheduled for Q2 2014 which will be very important as it could confirm or even improve the PEA results, and derisks and fine-tunes the project further. The release of a Feasibility Study (FS) is planned for Q1 2015, just as the application of the extraction permit, which is expected to be granted in Q2 2015. When the FS is positive, or even after a positive PFS, construction is expected to begin in Q3 2015, and production in Q1 2017.

One issue that can have a very large, positive impact on the business case of Tasman Metals, is the increasing of pricing of rare earth minerals. Prices have come down 80-95% since the absolute peak in 2011, stabilizing roughly at 100-300% above 2010 prices. Shortages in the rare and expensive heavy REEs cannot be ruled out, as China is assumed to be on its way to be a net importer of these minerals, and worldwide demand increasing year on year, depending completely on Chinese production.

There are also negative catalysts. As the rare earth industry is dominated by China (92-97%), any interruption or increase of supply by this country could have serious ramifications for pricing levels globally, rendering the case of Tasman Metals less positive in case of supply increase. I explained in

another article why I don't consider China a very trustworthy party to deal with, this will remain a risk for some time to come. For now the situation seems to be under control, but as China has its own agenda things could change rapidly.

It is this dependency on China that makes this industry vulnerable to speculation, as is shown in past years. This speculation has decreased considerably as most Western Hemisphere REE companies are more or less derisked and REE prices seem to have bottomed out after China normalized exports again, but will continue until especially heavy rare earth minerals are being produced in considerable quantities outside China, breaking the Chinese monopoly.

Other risks are of course negative results and outcomes on all scheduled estimates and reports. I don't expect the resource estimate and PFS to disappoint, as the deposit is very consistent and the PEA is already conservative in its fundamental metrics. In the longer term (2014-2015 onwards) some of the competitors could cause problems when they manage to commence commercial production before Tasman Metals does, as they are more likely to provide enough supply first and win the HREE production race in this case. Despite a lot of rosy schedules of these competitors, this isn't very likely to happen as already further advanced companies have serious disadvantages in raising funds for construction, being able to compete on HREE territory, or obtaining mining permits.

9. Conclusion

As is probably clear by now, Tasman Metals is a very compelling development story. With its project fundamentals it could be considered low risk on permitting, very profitable, easy to finance and to be built fast, and therefore best in class compared to all advanced HREE-exploring companies. Although there are several risks surrounding this particular sector, predominantly attributable to China who currently dominates REE production, when this very country would eventually become a net importer within several years I will expect this situation to reverse into a more standard supply/demand environment.

If everything goes as planned, Tasman Metals has a front row seat to benefit from these developments, as it should be able to commence commercial production as one of the first HREE companies globally as more advanced competitors already experience setbacks in development or have serious disadvantages. Taking into account a current share price of $0.72 (10/11/2013), based on 60.85M shares we get a target share price of $1.08, for an estimated profit of 50% at this moment. On the longer term this stock could be worth waiting for, as the target share price is estimated at a necessary but still very conservative NPV discount of 50% at $5.94 for an estimated profit of 725% in 2017.

(click to enlarge)

Norra Karr project, site view