Hopefully, this article will help you grow your assets.

Alcoa Inc. (NYSE:

AA) engineers and manufactures lightweight metals worldwide. The company operates in five segments: Alumina, Primary Metals, Global Rolled Products, Engineered Products and Solutions, and Transport and Construction Solutions. Alcoa intends to spin off Arconic (NYSE:

ARNC) on November 1, 2016 before the market opens.

Arconic will be the downstream company with Global Rolled Products, Engineered Products and Solutions, and Transportation and Construction Solutions. Alcoa will retain its own name, and it will have the Alumina and Primary Metals businesses. If you wish a more thorough description, follow this

link.

The split of Alcoa into two separate companies is expected to unlock value in both companies. First, when they are separated, the less complex companies are expected to get more investor attention simply because they should be more understandable. Second, Alcoa has a very low Price/Book (mrq) ratio of 1.02. When you remember that Alcoa's Book Value has been written down due to historically low commodities prices, the 1.02 Price/Book (mrq) ratio looks a lot lower.

A similar stock such as E.I. du Pont de Nemours and Company (NYSE:

DD) has a Price/Book (mrq) ratio of 6.03. 3M Company (NYSE:

MMM) has a Price/Book (mrq) ratio of 8.61. United States Steel Corp. (NYSE:

X) has a Price/Book (mrq) ratio of 1.52. Nucor Corp. (NYSE:

NUE) has a Price/Book (mrq) ratio of 1.98. All of these Price/Book ratios are significantly higher than that of Alcoa. Third, smaller companies are generally allowed to trade at higher Price/Book multiples.

Finally, Alcoa (both Alcoa and Arconic) have been making productivity cost gains that appear to have no near-term end in sight. These along with expected higher Aluminum prices should lead Alcoa to higher profitability in the future (better P/E ratios). On a Price/Book ratio basis alone, the split up could translate into as much as a 75% gain in composite stock price.

50% of this might come from the move of the P/B ratios from 1 to 1.5 soon after the split. Over time as Aluminum prices rise, the Book Value may get written up by perhaps 25%. This would make for a 75%+ gain. All of the other items listed above should act to support stock price gains too, especially profitability.

The recent bad news in Q3 2016 was that Alcoa missed on EPS and Revenues and the stock price took a beating. EPS missed by -$0.03 per share at

$0.32 per share (adjusted Net Income of

$161 million). This was not the disaster many seemed to think it was. There were costs associated with the split of the company. Net Income was higher at $166 million (or $0.33 per share). Revenues missed by -$120 million at $5.21B (-6.5% year over year).

Lower Revenues were largely due to curtailed and closed operations and lower pricing, especially on alumina. Non-essential asset sales are expected to total $1.2B in FY2016. Alcoa has received $935 million of that year to date. In Q4 2016 Alcoa expects other potential asset sales of approximately $250 million. Alcoa has $1.9B cash on hand.

It also had productivity gains of $377 million across all segments year over year. It has had productivity gains of $1.116B year to date; and there are a lot more cost savings to come. Such savings should help Alcoa's bottom line immensely over time, as the productivity cost improvements are expected to continue for a long time.

An anomaly in Q3 2016 was the 44% tax rate. This was caused mostly by expenses related to the separation of the two companies and the previously completed sale of the company owned life insurance policies. Excluding all special items, Alcoa's tax rate on Operating Results was 30%. Whew! Cash from operations was $306 million. Free Cash Flow was $31 million. Cash used for financing in Q3 2016 was $154 million. Cash used for investing was $220 million.

Alcoa's stock closed at $31.51 per share on October 10, 2016 (the day before the earnings announcement). By the close on October 17, 2016, it had fallen to $26.35 per share (down about -16.4% in a week). Alcoa's stock price has since recovered a bit to $26.86 per share as of the close on October 24, 2016. After the large pullback after earnings, the stock(s) are much more likely to rise on the November 1, 2016 split into two companies -- Alcoa and Arconic. They may well rise considerably before the split.

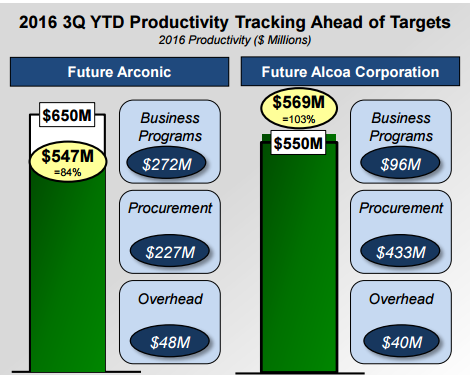

The Q3 2016 results also show that Alcoa has been making excellent progress in its productivity improvements. In fact, the results are tracking ahead of plan (see

tables below).

The segment that will be Alcoa after the split off of Arconic was already at 103% of target as of Q3E 2016. The segment that will be Arconic was at 84% of target as of Q3E 2016. The total productivity gains for both on the year were $1.116B at Q3E 2016. That's good money in virtually any company's book. More gains are expected in Q4 and in future quarters and years.

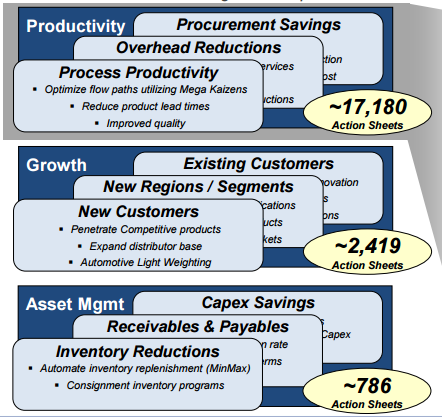

Plus Alcoa (the pre-split company) still has 20,000+ ideas that it can implement; and employees continue to suggest more. Wow! It would seem the company can keep improving for many years to come, and that should continue to improve the bottom line for a long time. The

tables below show a more descriptive breakout of the 20,000+ ideas. The company does not specify exactly what the ideas are. Competitive reasons likely account for the lack of specificity.

The specificity of the above Productivity Improvement ideas may be missing, but it is hard to argue with the $1.116B in savings that Alcoa has achieved with ideas from the above lists year to date. Presumably, Alcoa used the best ideas first, but there virtually have to be many more good ideas left in the lists. Continued productivity improvements can likely be expected for many years to come.

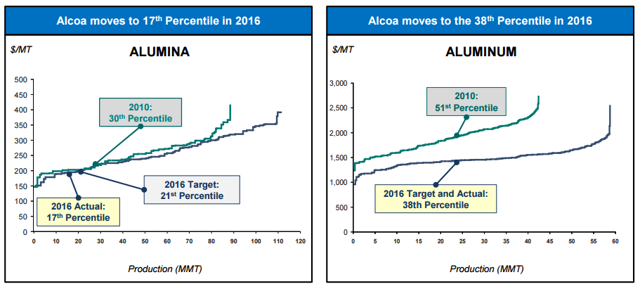

If you look at the Alumina and Aluminum charts further below, you will also see that there Alcoa has good room for improvement in its percentile ranking for the production costs of Alumina and Aluminum (and likely many other things as well). The case for increased profitability from productivity gains in future years is a strong one.

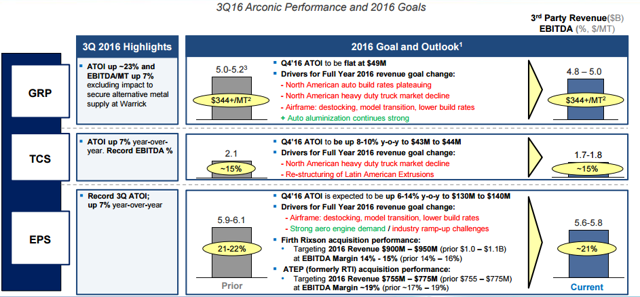

The

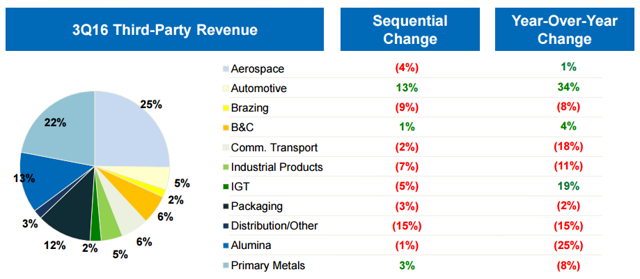

tables below show the Arconic segments Q3 2016 performance and its FY2016 / Q4 2016 goals. Arconic is again the part of Alcoa that makes the manufactured products (or the downstream products) as opposed to the upstream mining operations, etc. of the Alcoa segment.

The red ink in the tables above indicates areas of weakening business. This does not mean the business is being destroyed. Instead, it likely reflects that Alcoa is a cyclical business; and the US economy may be in the process of cycling down. Notably the auto, truck, and airframe businesses seem to be slowing. Yet Arconic is still expecting to see flat to good gains in ATOI ("after tax operating income"). This is the mark of a well run company, but it still indicates the US economy may be cycling down, and Alcoa is a cyclical business.

For the Alcoa segment of the business, the charts showing the decreased production costs per ton of alumina and aluminum speak volumes about the management of the company (see

charts below).

Both for Alumina and Aluminum production, Alcoa managed to improve its costs per tonne while keeping roughly the same production level for Aluminum and a somewhat lesser production level for Alumina.

As readers can see in the

chart and table below, the Alumina segment of Alcoa's business apparently had much lower revenues mostly due to lower prices.

It is a good thing that Alcoa managed to decrease Alumina production costs as the price of Alumina dropped from about $430/tonne (Australian Alumina in USDs) in June 2015 to

$287/tonne on September 9, 2016 (about -33%).

I could go on about Alcoa, but it appears to be a well-run company. Lately, it has been becoming a better run company. It is probably a good bet that it will continue to be a well-run company over the next several years. For this reason, it may be more appropriate to look at materials forecasts at this time. The

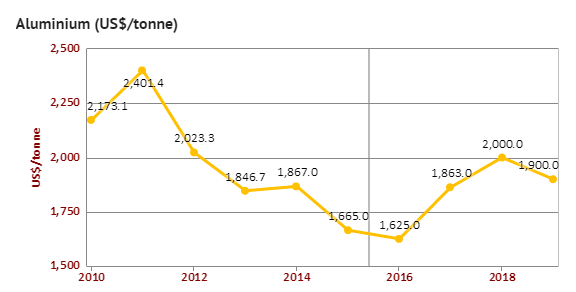

chart below shows the Knoema forecast for Aluminum prices for the next several years.

2016 Aluminum prices are expected to be low. If we see a worldwide slowdown (and/or a US recession), we may see prices go below 2016 levels. However, I will use the best estimates at this time for the purposes of this article. For that, Aluminum prices are expected to rise from $1625/tonne in 2016 to $2000/tonne in 2018 (about +23% in total). Such a rise should be a huge boon for Alcoa, especially after it has dramatically cut production costs in recent years.

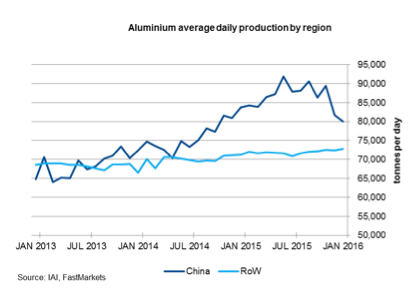

The outlook with respect to Aluminum can be said to be good to great. There is a glut of Aluminum still; but historically that has corrected itself at times like this one. Producers have cut back; and that is what is happening now. The

chart below (from FastMarkets and Sucden Financial) showing Chinese production shows that Chinese production has been rapidly decreasing of late; and China is the largest producer worldwide.

The dark blue line above represents Chinese production. It is still trending nicely downward. In addition, the longer-term price chart for world Aluminum prices indicates that there is a good technical basis to believe Aluminum may have found a bottom (see

chart below).

The yellow line above is a technical support line. It should make it harder for Aluminum prices to fall below that level. The bounce looks like it should continue at least until the top of the channel shown in the chart. That means Aluminum prices are likely to go at least to $1750/tonne in the near term. I am hoping they break out of the channel. There is good technical reason to believe that they may. In addition, the table above shows that consumption is already exceeding supply in 2016.

If the Chinese production trend continues downward, then that balance should show consumption exceeding production by even more soon. The problem currently is the built up stocks of Aluminum. However, the stocking issue may correct soon if the above balance goes still further negative. Remember, China wants higher Aluminum prices too. Remember also that the US has been acting against steel dumping by China especially, and it has been

acting against aluminum dumping too.

Apparently, Obama and Donald Trump are in agreement on this item. That should mean that US companies will get a good to great opportunity to supply US automakers/truckmakers and US airplane makers at healthy Aluminum prices. These anti-dumping actions are another good reason to believe that the Chinese production trend will continue downward at least for a while. That by itself should eventually lead to further recovery in Aluminum prices. The following is a quote of the recent US review (

81 FR 51858) of its anti-dumping tariffs on Chinese Aluminum.

"The Department of Commerce (the Department) finds that revocation of the countervailing duty (CVD) order on aluminum extrusions from the People's Republic of China (PRC) would likely lead to the continuation or recurrence of a countervailable subsidy at the levels indicated in the Final Results of Review section of this notice."

In other words, the US tariffs on Chinese Aluminum will continue for the foreseeable future. This should be a positive for Aluminum prices within the US. It should be a positive for Alcoa's Aluminum prices.

I was unable to quickly find forecast charts for Alumina and Bauxite. However, from my reading, many forecasters expect both Alumina and Bauxite prices to go up from their levels in 2016. When you consider that you use Alumina/

Bauxite to make Aluminum, this makes sense. Hence, the outlook for the sales prices of these materials by Alcoa is

positive at this time. Overall, that means that the outlook for Alcoa's profit growth is positive.

In sum, the price outlook for the materials that Alcoa supplies/produces is positive for 2017 and 2018. That should translate into growth in profits for both 2017 and 2018. It should translate into an increase in Book Value in those years. The argument for higher composite stock prices is detailed near the top of this article. Remember also that Arconic (

ARNC) will own

19.9% of the split off Alcoa, so it should benefit over time if Alcoa's profits grow as expected.

Alcoa appears to have found a bottom, and it has started a weak uptrend. With the positive price forecasts for aluminum for the next couple of years, the fundamentals for the company look promising. The above fundamentals should be big positives for Book Value, Revenues, and EPS. Then the split up of the company into two companies on November 1, 2016 should unlock value on a Price/Book basis and a P/E basis in addition to the "expected" improvement in the fiscal metrics of Alcoa.

Add that technically Alcoa is in a very good position for the stock to rally. Then I have to rate Alcoa a Buy at this time. Yes, the breakup could cause a few problems, but any such problems should be short-lived. A Buy of Alcoa at this time appears to be both a good to great trading opportunity and a good investment opportunity.

NOTE: Some of the fundamental fiscal data above is from Yahoo Finance.

Good Luck Trading/Investing.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AA over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.