Bear of the Day: Campbell Soup

Campbell Soup (CPB) may have a great history of beating the number, but lately estimates have turned south. CPB is a Zacks Rank #5 (Strong Sell) and it is the Bear of the Day.

Big Time Winning Streak

Just beating the number all the time will not keep a stock from being a Zacks Rank #5 (Strong Sell). The rank is more about the estimate revisions that look forward as opposed to the earnings beats which are historical in nature.

That said, the Bear of the Day does have a two year win streak on its hands. Actually it is a quarter longer than that, as CPB has beat the Zacks Consensus Estimate in each of the last 9 quarters.

Company Description

Campbell Soup produces branded convenience food products. The company operates in three business segments: Soup and Sauces, Biscuits and Confectionery, and Away From Home. Campbell Soup was founded in 1869 and is headquartered in Camden, New Jersey.

Earnings History

As mentioned earlier, the soup maker has had a great run of earnings beats. Despite all these beats, the stock has not reacted all that positively. In five of the last six earnings, the stock has traded lower in the session following the announcement. That does not leave a good taste in investors' mouths.

The most recent report saw a big negative surprise on the topline. The company reported revenue that was $107 million less than expected for a 5.85% negative revenue surprise. The marked only the second time in the last seven reports that the top line came in below expectations.

Earnings Estimates Slip

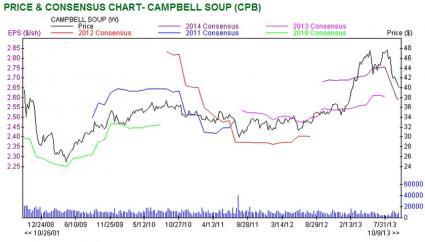

Estimates for CPB have slipped of late, the main reason the Zacks Rank has fallen. The Zacks Consensus Estimate for 2013 stood at $2.76 in July, but fell to $2.67 in August and then down to $2.59 in September.

Similarly the 2014 estimate has moved from $2.90 to $2.77 to $2.74 over the same time horizon.

The downward trend in estimate revisions is one of the biggest factors that can cause a stock to become a Zacks Rank #5 (Strong Sell).

Valuation

The valuation picture for CPB is pretty much where you might expect it to be. A 15x trailing and forward earnings multiple show a slim discount to the industry average, While price to book of 10x is almost three times as high as the industry average. Its price to sales multiple of 1.6x is below that of the 2.2x for the industry average. I like to look at revenue growth, and fiscal 2015 is expected to see 2.3% growth vs a 4.3% growth rate for the rest of the industry. That tells me the market is growing, but CPB may not be adding share as fast as its competitors.

The Chart

The price and consensus chart really tells the story of what is going on at CPB. The estimates started moving lower a few months ago, and when they did the stock fell from its recent highs. Established companies in more defensive industries tend to trade in line with the earnings estimates, making the rank a great short term indicator for stocks like CPB.

- CAMPBELL SOUP (CPB): Free Stock Analysis Report (email registration required)

About the author: Zacks Investment Research

Nov. 19, 2013, 7:55 a.m. EST

Campbell Soup earnings fall 30%; cuts year view

By MarketWatch

Campbell Soup Co.'s CPB -0.08% fiscal first-quarter earnings fell 30% as retailers reduced inventories, particularly hurting the U.S. soup business, and the company boosted spending to market new products in its U.S. soup and simple meals divisions.

Results missed expectations, and the company reduced its guidance for the new year.

"I'm disappointed in Campbell's first-quarter performance," Chief Executive Denise Morrison said. "While we anticipated a challenging first quarter, the impact from retailer inventory movements was greater than anticipated."

She said retailer inventory movements in the U.S. Soup division lowered sales by about 4%, making up two-thirds of the decline versus the prior year. Meanwhile, marketing spending to support new products in the U.S. soup and simple meals divisions helped push total advertising and consumer promotion expense up 14%.

The food products maker lowered its guidance and now expects adjusted earnings to grow 2% to 4% to $2.53 to $2.58 a share, while sales from continuing operations are expected to increase 4% to 5%. In August, the company guided for an earnings increase of 3% to 5% and a sales jump of 5% to 6%.

Campbell Soup--which also makes Pepperidge Farm baked goods and V8 juices--has worked to turn around its soup and simple-meals operations while looking to expand its healthy beverages and baked snacks businesses. The strategy has helped Campbell boost revenue recently. The company has also made acquisitions as it has sought to grow beyond its soup business.

For the period ended Oct. 27, Campbell reported a profit of $172 million, or 54 cents a share, down from a year-earlier profit of $245 million, or 78 cents a share. Excluding restructuring, tax expenses and other items, earnings from continuing operations dropped to 66 cents a share from 84 cents.

Sales declined 1.8% to $2.17 billion as sales in all but one segment dropped.

Analysts polled by Thomson Reuters had most recently forecast per-share earnings of 86 cents on sales of $2.29 billion.

Gross margin narrowed to 35.9% from 37.2% on the costs related to acquisitions and a recall of Plum Organics products.

In the global baking and snacking segment, which includes the Pepperidge Farm brand, sales rose 6% to $609 million.

However, the company's simple meals segment sales fell 4% to $860 million while U.S. beverages posted an 8% sales decline.

Sales for international simple meals and beverages fell 13%.

Shares were inactive premarket. Through the close Monday, the stock was up 20% this year to $41.81.

39,20 USD

-6,24% | -2,61

19/11/2013 22:02

Aucun commentaire:

Enregistrer un commentaire