Summary

- Intel released its Q2 report after the market closed Wednesday.

- After estimate revisions were made prior to the released, Intel beat on earnings.

- This report bolsters the claim that Intel is able to survive in a harsh PC downturn.

Up until now, the titles of my "Earnings Reporter" articles would generally look like "Company A: The Earnings Reporter Edition". As you can tell by the title of this article, I've changed things up a bit. By immediately introducing my opinion on the stock in the article's title, I am giving as clear advice as possible. My goal in this segment is to unlock both short-term and long-term growth in stocks that have just reported earnings. These stocks are specifically subject to enormous volatility, as earnings is seen (and rightfully so) as a huge aspect of a company's progression. What I offer you is an analysis of the economic well-being of the company, and whether I think the stock is a Buy, Hold, or Sell for either (or both) the short-term or long-term. After careful analysis of Intel Corporation (NASDAQ:INTC), I have ranked the company as a Buy.

Investors' Fear and Pessimism

Well, it's true. The PC market has been all but friendly to Intel Corporation. Earlier this month, the International Data Corporation estimated that PC sales for Q2 2015 totaled 66.1 million units, representing a huge 11.6% decrease compared to last year. A few days later, a Seeking Alpha article was published, titled "Intel: Preparing for Bad News". This title represents investor sentiment towards Intel over the past few weeks. Here is another article from USA Today about the negative expectancy people had towards Intel. Also hurting the multi-billion dollar company is that Windows 10 is offered for free on PCs currently running Windows 7 and Windows 8.1. Rather than storming the stores to buy new PCs equipped with the most recent and supposedly great software, consumers will for the most part elect to keep the PC they are currently using. This means that Intel is missing out on a huge revenue stream, as it is the main chip supplier for most PCs. Sales are not expected to stay down for too long, however. IDC analyst Mario Morales had this to say on the impact of Windows 10:

It's going to take some time for [Windows 10] to really start kicking into the market, especially around the enterprise, and I think that would really have to happen to drive a really nice uptick in the market

With all this clamor about the decline in the PC market, investors were steadily united in predicting a poor quarter for Intel. Things have only gotten more unsteady as competitors such as Micron, AMD, and QLGC have all been reporting weakening metrics. Hell, Intel themselves offered revenue revision to its original $13.2 middle point estimate. The new figure given was $13.06 billion, coupled with a prediction for $.50 in Earnings Per Share. Furthermore, analysts are predicting Intel to experience a decrease in annual revenue by approximately $1 billion (around 1.7% compared to 2014), and to post an EPS of $2.11, around 10% lower than the $2.33 EPS figure from 2014.

Intel has already dropped around 20% for the year.

Was this negative investor outlook appropriate? Was it warranted? Well, yes. The PC market is where Intel generates a majority of its revenue. It is an essential revenue stream for Intel. After much speculation, Intel finally released its earnings, and with the release comes the warm embrace from the Intel believers.

Intel's Q2

In the end, Intel had the revenue it expected all along. Corny references aside, Intel posted the $13.2 billion figure that was expected earlier on in 2015. Yes, this is still more than a 4% drop Y/Y, but it was expected to be much worse. Intel also surprised with EPS, showing a figure of $.55. Gross margin even improved 200 basis points from last quarter, up to a healthy 62.5%.

It is essential to check out how Intel's individual business segments performed, helping us get a well-rounded idea of Intel's current standing.

To quickly summarize what each of Intel's segments entail, I will use the definitions given in the Q2 report:

- Client Computing Group: Includes platforms designed for the notebook (including Ultrabook™ devices), 2 in 1 systems, the desktop (including allin-ones and high-end enthusiast PCs), tablets, and smartphones; wireless and wired connectivity products; as well as mobile communication components.

- Data Center Group: Includes server, network, and storage platforms designed for enterprise, cloud, communications infrastructure, and technical computing segments.

- Internet of Things Group: Includes platforms designed for embedded market segments including retail, transportation, industrial, and buildings and home, along with a broad range of other market segments.

- Software and services operating segments: Includes software and hardware products for endpoint security, network and content security, risk and compliance, and consumer and mobile security.

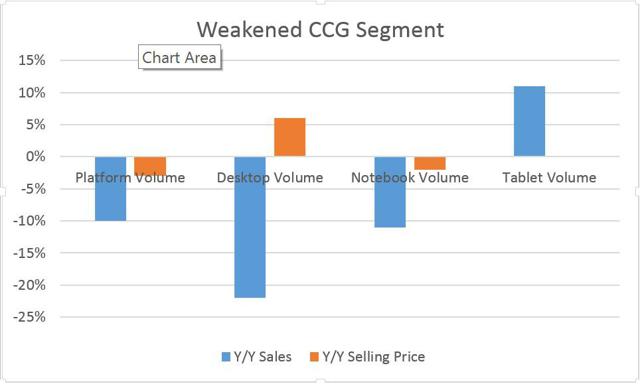

Intel's Client Computing Group $7.5 billion in sales pale in comparison to last year's Q2, but is actually up 2% sequentially. Virtually every aspect of the business segment was down compared to 2014.

This decline was expected in lieu with PC sales tumbling down. Tablet success is obviously a positive to take away from the performance, but this shouldn't be replicated as the PC market climbs out of its hole. Many tablets still lack the complete functionality that comes with PCs. A gap is still needed to be bridged.

Next, we go on to the company's Server revenue, in the form of the Data Center Group segment. This business segment brought home $3.9 billion for Q2. This is a 5% increase from last quarter, and a 10% increase from Q2 2014. It brought home over $1.8 billion in operating income, the most from any business segment. Intel has stressed the importance of this segment, as it is cheaper to operate than its CCG segment, and delivers strong sales. Unit volumes were up 2% and 5% for Q/Q and Y/Y respectively. In addition, average sales price increased by 3% and 5% for Q/Q and Y/Y performance. Intel is generating more volume and obtaining larger payments for its DCG products.

The Internet of Things Group (dubbed IoTC) also impressed. Revenue for the IoTC segment increased 4% sequentially, and 5% Y/Y. Total revenue for the segment was $559 million.

Lastly, Intel's Software and services segment generated revenue of $534 million, flat sequentially and down 3% Y/Y. Intel's "other" segment produced $715 million, up 38% from 2014. This segment includes flash memory and devices.

Well, there you have the segment breakdown. Now I'll explain the guidance situation, and how Intel is still a great company for shareholders.

Guidance Game and Miscellaneous

No doubt investors were curious about Intel's outlook for both Q3 and the rest of 2015. Intel offered expectations that seem reasonable, and perhaps beatable.

For Q3:

Revenue is expected to be $14.3 billion, which would be over an 8% sequential increase. This means that Intel immediately expects Windows 10 to help bolster revenue significantly. My concern is that if they are wrong and overestimate PC sales in relation to the new software release, analysts and investors alike will come down hard on the company (and rightfully so). Margins are also expected to be stronger in Q3, with a 63% figure currently predicted. Intel is somehow finding ways to cut operating expenses, and they should be commended for it. Intel is already upping the ante with higher R&D expenses than expected, so it's a good sign that they are saving elsewhere. R&D will continue to be around $4.9-$5 billion, especially after other technological breakthroughs are occurring, such as the new capabilities for the 7nm chip that IBM is developing. Whether or not the development of 7nm chips would be a profitable venture at this point is a discussion for another time. The point is that other companies are having breakthrough discoveries, and it is good to know that Intel does not plan on lessening its R&D.

For 2015:

Revenue for the 2015 year is expected to fall about 1% short of last year's number. This shows two things: One is that Intel has come to terms with the fact that they cannot replicate last year's revenue (they finally altered their "flat" revenue expectation). Second is that this number is much lower than the near 2% decline that many analysts were calling for. Margins are expected to come in a 61.5%, a very solid number considering the start-up costs for the production of Intel's 10nm chips. R&D spending for the year is expected to be around $19.8 billion, plus or minus $400 million. As I just explained, R&D spending shows the commitment of Intel's management in discovering a new scientific breakthrough, and I commend them for it.

Speaking of management, let's look at what Intel does for its shareholders. After spending $4 billion on stock buybacks in 2014's Q4, then another $750 million in buybacks in Q1, it was great to see another large buyback totaling $697 million for this quarter. Q2 for Intel ended with $16 billion in cash/investments, so they are poised to continue this for the time-being. Also, they sport a charming current ratio of 1.97, showing that they will easily maintain operations and avoid being hindered by current liabilities. Intel also paid cash dividends totaling $1.1 billion.

Conclusion

Intel's Q2 report largely shocked the investment world, offering figures well above expectations. Skepticism is still properly in the air, as the PC market continues its decline, but Intel has demonstrated its capability to thrive in a nasty environment. With a solid guidance for the rest of the year, and a healthy share buyback and dividend system in place, Intel offers a compelling investment.

Aucun commentaire:

Enregistrer un commentaire