Alcoa: You'll Have To Wait Longer Than The Split

Summary

The Alcoa-Arconic split looms ever closer.

Heading into this split we might see investors react to Arconic rather harshly, but we must realize that Arconic's market segments will take time to improve.

The upstream legacy business has positioned itself wonderfully to capitalize on its own improved cost efficiency once aluminum prices eventually rebound.

While looking at Alcoa's (NYSE:AA) current metrics I realized that the stock's ongoing valuation provided a wonderful opportunity to get in on some juicy gains. And while you might think that I'm going to point out that the stock is overvalued or undervalued I actually believe that right now it is trading at its fair market value, and that's great news. Let me tell you why:

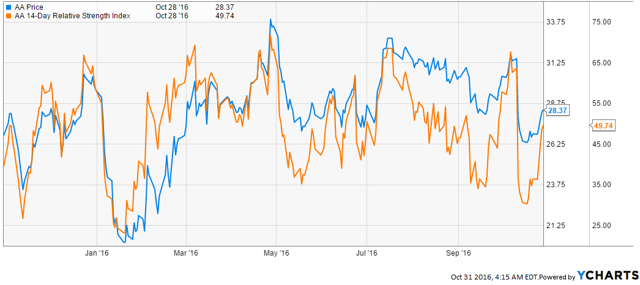

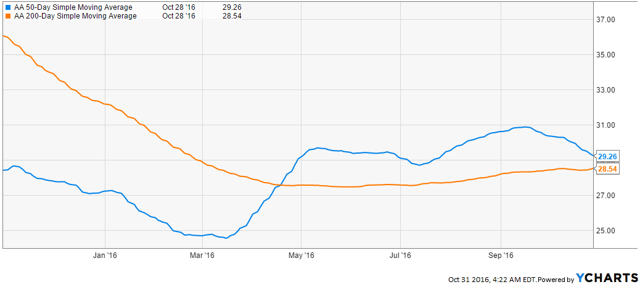

First of all a quick look at AA's Relative Strength Index (RSI) reveals that the company stock is floating very close to a neutral position even after it dropped earlier this month. However along with the 50-day and 200-day moving averages we can see that there is some upside to the stock still. One of the reasons behind the AA's concealed potential as a stock is that investors seem to be unsure, if not optimistic, about the stock split. There aren't many analysts out there who are classifying the split as a terrible idea.

(Source: YChart)

Talking about the latest earnings is futile, because so close to such an important moment in the company's history, that too in a time when aluminum prices are struggling. But the latest earnings report does show that the company was straining itself over expenses related to the split, which once accounted for shows that the company's cost-cutting strategies have been paying off. I believe that once the split does materialize on 1st November we'll see margins for both the upstream and downstream businesses improve to an even greater proportion. That's because in the current model Alcoa tends to erode its gains in one segment by bleeding out of another. Once Alcoa and Arconic (NYSE:ACRN) are independent they will be able to realize their own gains and/or losses, giving investors a better view of judging the stocks.

Now I have to point out that coming out of this split Arconic will emerge in a better position than its soon-to-be-split upstream Alcoa, but let's not get ahead of ourselves. The aerospace industry, along with the automobile industry, is not experiencing the sort of robust growing demand it usually faces. It's unlikely that the two industries will see conditions improve within the next year, so what we might end up seeing is a harsh reaction to ACRN once it does hit the market as investors might feel let down by a stock they anticipated so eagerly.

But in the long run ACRN is positioned to capitalize on its innate high-margin model and capture the upcoming aerospace industry boom. Let's keep a conservative target of 2018 for Arconic, a year when we should start to see things speed up in the aerospace and automobile industry in general.

On the other hand we have the upstream legacy business which has a historically strong link with aluminum prices. Alcoa was brilliant in using this tough period to focus on cutting costs and improving efficiencies. In a way their decision to split the upstream and downstream businesses is ultimately a massive cost saving move, one which should pay off marvelously once aluminum prices improve. And like I mentioned in my previous articles which have covered Alcoa the future outlook of aluminum prices seems to show an upward trend in the upcoming years.

To further facilitate this forecast a recent report by Will Adams of FastMarkets.com shows that a considerably stronger rebound in the Shanghai Futures Exchange price shows that the Chinese are actively trying to curb the oversupply in the aluminum markets across the world, a glut in which they allegedly have a massive role. If this piece of information is true then this should be considered the start of the turning point for aluminum price trends. Once aluminum prices do start to rise we should see Alcoa take advantage of its improved efficiency.

So what should you do with the Alcoa split? My advice is to view it as a long term holding. Both Alcoa and Arconic are going to emerge from this seemingly weak, however they're positioning themselves for substantial growth once market conditions improve. Especially considering the aerospace industry and the metal market I just discussed we have to realize that it's no longer a matter of if things will improve, it's just a matter of when. I admit it's a waiting game which could take your investment up to 2 years to realize a gain, but going into this split and not grabbing AA at its current price seems foolish to me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Aucun commentaire:

Enregistrer un commentaire