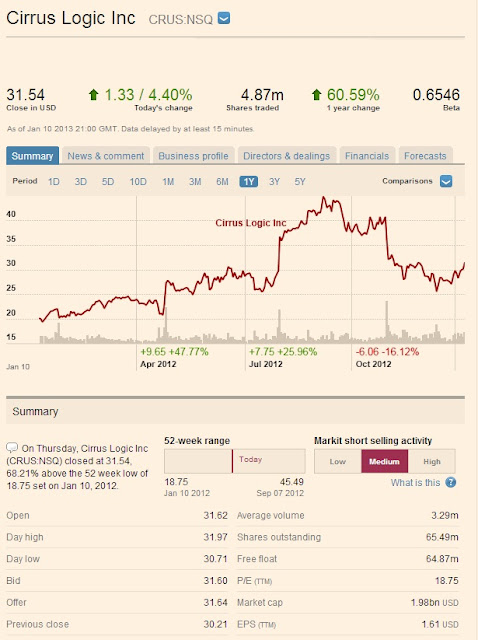

CIRRUS LOGIC INC COM USD0.001 (CRUS)

31,54 USD

+4,40% | +1,33

10/01/2013 22:00

COMPANY RESULTS: Cirrus Logic Inc. (NASDAQ: US:CRUS)

After Hours

4:42 p.m.

$

31.21

Change

-0.33 -1.04%

Volume

40,829

Real time quotes

Day low

Day high

$30.71

$31.97

52 week low

52 week high

$19.10

$45.49

32.00

31.50

31.00

30.50

30.00

10a

12p

2p

4p

Market cap

$1.98B

Average volume

3.67M

P/E ratio

19.59

Rev. per Employee

$777,780

EPS

1.61

Dividend

N/A

Div yield

N/A

Ex dividend date

N/A

Company Description

Cirrus Logic, Inc. develops high-precision, analog and mixed-signal integrated circuits for audio and energy markets. It delivers optimized products for consumer and commercial audio, automotive entertainment, and targeted industrial and energy-related applications. It also develops ICs, board-level modules and hybrids for high-power amplifier applications branded as the Apex Precision Power line of products. The company product lines include: Audio & Energy. The Audio product line develops high-precision analog and mixed-signal components, as well as audio digital signal processor products for consumer, professional and automotive entertainment markets. The Energy product line develops high-precision analog and mixed-signal components for energy-related applications, such as energy measurement, energy exploration and energy control systems. It also includes ICs, board-level modules and hybrids for high-power pulse width modulation and power amplifier applications. Cirrus Logic was founded by Suhas S. Patil and Michael L. Hackworth in 1984 and is headquartered in Austin, TX.

More Cirrus Logic, too ...

I won't spend as long discussing my second buy, in part because it's an Apple derivative play. I'll be picking up a bit more Cirrus Logic (NASDAQ: CRUS ) .

The company definitely comes with its risks, as a whopping 79% of its revenues came from Apple last quarter, but it's also been expanding its role in Apple's products.

Simply put, it's a company that's sold off quite a bit recently, and the sell-off has been baffling to me. In the December quarter, Cirrus guided to sales that would be up about 145% year over year on the high end of its guidance. The reason is simple, Cirrus Logic made major gains in the amount -- and value -- of its chips going into the new iPhone 5. Those eye-popping rates will come back to Earth later next year, but by the time they do, the company will be trading at single-digit earnings multiples.

Why's Cirrus selling off in spite of such great news with Apple? Well, the company guided to margins that could be decreasing 2 to 3 percentage points concurrent with its massive rise in revenues. This seems like an overblown concern to me. I'll quote Cirrus Logic CEO Jason Rhode on his reaction to the situation:

"Achieving approximately double the revenue with only a few points of margin erosion is a trade-off most semiconductor companies would happily make in light of the huge growth in operating profit that this drives."

That about sums up my reaction as well. In any case, I'll be adding 20 more shares of Cirrus to my portfolio tomorrow. That's a smaller buy than Apple, but it's also a smaller and riskier company.

Directors & officers

| Name | Title | Compensation | Age | Officer since | |

|---|---|---|---|---|---|

AlanSchuele

|

Chairman of the Board

| -- |

66

|

2012

| |

Mr. Alan R. Schuele has been appointed as Chairman of the Board of Cirrus Logic, Inc., effective August 01, 2012. Mr. Schuele was first elected to Cirrus Logic's Board of Directors in July 2011. Schuele has been a general partner since 2000 with Sevin Rosen Funds, a high tech venture capital firm, and is currently a director of Javelin Semiconductor. Prior to Sevin Rosen, he was chief executive officer of Benchmarq Microelectronics and served as president, chief operating officer and a director of the Board of Unitrode Corp. after its merger with Benchmarq. Other past semiconductor company experience includes various sales, marketing, and executive positions at Cirrus Logic, Crystal Semiconductor, Cypress Semiconductor, Mostek, Motorola and Texas Instruments.

| |||||

JasonRhode

|

President, Chief Executive Officer, Director

|

454.72k USD

|

42

|

2004

| |

ThurmanCase

|

Chief Financial Officer, Vice President, Principal Accounting Officer

|

263.94k USD

|

55

|

2002

| |

ScottAnderson

|

Senior Vice President, General Manager - Mixed-Signal Audio Products

|

279.29k USD

|

58

|

2007

| |

GregoryThomas

|

Vice President, General Counsel, Corporate Secretary

|

295.50k USD

|

46

|

2003

| |

GregoryBrennan

|

Vice President, General Manager - Apex Precision Power

| -- |

50

|

2008

| |

ThomasStein

|

Vice President and General Manager - EXL Products

|

237.01k USD

|

40

|

2008

| |

TimothyTurk

|

Vice President - Worldwide Sales

| -- |

55

|

2007

| |

Jo- DeeBenson

|

Vice President - Corporate Marketing Communications and Human Resources

| -- |

52

|

2000

| |

RandyCarlson

|

Vice President - Supply Chain Management

| -- |

46

|

2010

| |

JohnCarter

|

Independent Director

| -- |

57

|

2009

| |

TimothyDehne

|

Independent Director

| -- |

46

|

2009

| |

WilliamSherman

|

Independent Director

| -- |

69

|

2001

| |

SusanWang

|

Independent Director

| -- |

61

|

2011

| |

Aucun commentaire:

Enregistrer un commentaire